By Dr. Suleiman Walhad

May 19th, 2022

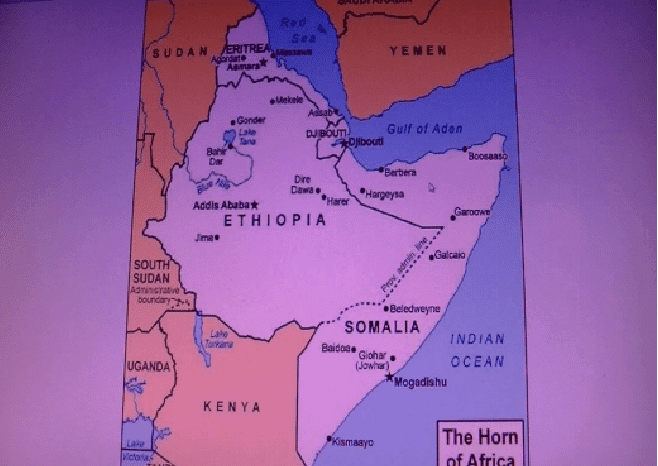

The Horn of Africa States (Somalia, Ethiopia, Eritrea and Djibouti – the “SEED” countries), is a fragile region, but as fragile as it is, it also offers above usual expected returns of normal markets. This is a region for the intrepid entrepreneur and not for the timid. The financial systems are dominated by the banking industry, and some other industries such as insurance, leasing, money transfers are also thriving, some more so than others. The Horn of Africa States banking and finance business, though closed business to foreign parties, for one reason or the other, remains a great untapped opportunity.

The Horn of Africa States (Somalia, Ethiopia, Eritrea and Djibouti – the “SEED” countries), is a fragile region, but as fragile as it is, it also offers above usual expected returns of normal markets. This is a region for the intrepid entrepreneur and not for the timid. The financial systems are dominated by the banking industry, and some other industries such as insurance, leasing, money transfers are also thriving, some more so than others. The Horn of Africa States banking and finance business, though closed business to foreign parties, for one reason or the other, remains a great untapped opportunity.

In Somalia, the civil war and the perceived risks therein entail caution on the part of global or even regional players, while in Ethiopia, it appears to be a government-imposed phenomenon. This has been the case since the modern Ethiopian state was founded. Eritrea also runs a closed economy where foreign players in the banking sector is also not allowed. Only Djibouti of the four member states of the Horn of Africa remains a free economy where one can easily install and operate from, and this is a big advantage to draw from. The same issues apply to the telecommunications and insurance industries.

The banking and financial system is mostly dominated by government owned institutions in some countries while in others the private sector plays a leading role. The region involves countries in transition stages moving away from civil strives such as Somalia, while others although more stable still remain underdeveloped in terms of the current levels of banking in the rest of the world, mainly because of rigidities of government controls and perhaps knowledge limitations.

Nevertheless, the region though remaining a challenging market, hosts tremendous untapped opportunities in terms of a large market onto which one can install new financial service providers or participate in existing financial organizations thus adding onto their present services and/or more efficiencies and better technologies. The region also owns substantive natural wealth including a large and cheap labor force and material resources such oil and gas, other minerals, farming and fishing opportunities and many other related products and services, including a large consumer market.

Economic growth in the region, although not high at present could be easily accelerated. Ethiopia a few years ago was growing at some 9%. Somalia was perhaps and for obvious reasons and mainly lack of data, growing at low levels of about 3%, but even then, better than many other countries. According to the World Bank, Somalia was exposed to a “triple shock” in 2020: the COVID-19 pandemic, extreme flooding, and locust infestation. However, its economic growth is expected to reach pre-COVID-19 levels of 3.2 percent in 2023. The financial sector development remains nascent.

The banking and financial system consists of the central bank, 16 private banks, 29 money transfer operators and one insurance company. Somalia is a natural open market and allows entry of foreign players in all of the markets, with one condition, perhaps – a consumer-imposed Islamic Shari’ah compliance. The risk profile of the country, however, remains an impediment to date. After the collapse of the Somali state three decades ago, the banking and financial system went private. It started in the form of rudimentary money transfer companies, where the huge Somali diaspora dispersed in the world, were able to send monies to their relatives and friends left behind in Somalia. These money transfer companies have grown with time in terms of sophistication and technologies, spilling over into the banking industry a decade ago. The total banking system to date remains compliant with Islamic Shari’ah, though the rulebook of the central bank remains a regular non-Islamic institution – a major contradiction which needs to be addressed during the incoming administration of President Hassan Sheikh Mahmoud.

The country is emerging from a long-drawn civil war and an extended fragile situation. The country’s constitution remains incomplete but, at least, it enjoys a federal infrastructure of governance, that has eased away some of the old issues, though creating new ones, as well. Nevertheless, it is slowly improving and the banking and financial system, in general, is also improving with it. Only recently did the Central Bank of Somalia, announce a new payment system connecting all the players in the market. Yet the banking and financial system, in general remains alone and lonely. A first step in the right direction in reconnecting itself with the world should, in our view, be to link with the banking systems of the region first, such as the banking systems of Ethiopia, Djibouti and Eritrea.

Ethiopia’s economy grew at 6.1% in 2020, down from 8.4% in 2019, largely because of the COVID–19 pandemic, according to the African Development Bank Group. Growth was, in the main, in the services and industry sectors. The hospitability, transport, and communications sectors were adversely affected by the pandemic and the associated containment measures against the spreading of the virus.

The Ethiopian government is reported to be planning to open the three industries of banking and finance, insurance and telecommunications. This requires parliamentary approvals and issuance of policies permitting the entry of foreign investors into the market. The local players of the industries benefitted greatly from the protection of the government, and it is imperative that the local players prepare themselves should the market be opened to foreign investors, in terms of modern architecture and technologies. The Ethiopian banking and financial system consists of the central Bank (the Bank of Ethiopia), a state-owned development bank (Development Bank of Ethiopia, a government-owned commercial bank (Commercial Bank of Ethiopia), and 16 private banks. It is further complemented by some twenty-nine microfinance institutions and ten insurance companies.

The African Development Bank in its report on Eritrea noted that Eritrea was affected by a locust invasion and the COVID–19 pandemic, and this impeded economic activity in 2020. Real GDP was noted to have declined to some 3.2% from 3.8% in 2019. The economy is dependent largely upon agriculture (some 40%) but there remain significant opportunities in the services industry such as tourism, extractive industries (mining), manufacturing (textiles) and generally trading, and others. Its economic outlook potentially remains favorable in the medium term, reflecting new mining operations coming on stream. Government restrictions remain an impediment, and relaxation of those restrictions will augur well for the country.

Eritrea’s banking and financial system is government owned and there are no foreign players. A private bank – the Augaro Bank was short-lived. Other than the central bank, there are three other banks all state owned except the Housing and Commercial Bank, which is owned by the ruling party. The other banks comprise the Commercial Bank of Eritrea and the Eritrean Investment and Development Bank.

Djibouti, by far, has the best developed banking system. It also enjoys a currency pegged to the United States Dollar since 1949, which is a great advantage for foreign investors coming into the market. Investments do not lose value as a result of devaluation of currency. There are also no foreign exchange controls as in many other countries in Africa or the region itself. These two aspects remain the main characteristics of the monetary system of Djibouti, which helps push its aspiration to becoming a regional financial hub. A robust regulatory framework of the Central Bank of Djibouti (Banque Centrale de Djibouti – “BCD”) led to the promulgation of new rules including risk assessment frameworks and shari’ah compliance, and new payment systems – which should help pave the way for increased retail and corporate activity.

The financial system of the country consists of banks, insurance companies and money transfer companies and exchange bureaus. The include the central bank, eight conventional commercial banks, three Islamic banks, and two insurance companies.

Despite the collapse of banks in the rest of Africa through either through consolidation or bankruptcies, the banking and financial system of the Horn of Africa remains resilient and even expanding. In Djibouti, the banking system rose from four institutions prior to 2006 to now eleven at present. In Somalia, the banking system prior to the collapse of the state was only three institutions and today consists of some seventeen institutions. Ethiopia, the banking system grew from three institutions prior to the collapse of the Marxist Derg regime in 1991 to now over nineteen banks. The Eritrean banking system remains small but then the country is also new and still accommodating the government owned institutions, it started with. An attempt to create a private bank failed. The banking system of the Horn of Africa is further supported by a plethora of money transfer companies and microfinance institutions.

Regulators are improving and improvising with this expansion and in order to keep up, are updating the old-fashioned rules and regulations to cope with the digital economies and modern technologies of service deliveries, which the populations are more adept with and adopting. Some of the regulators had difficulties with adopting the presence of Islamic banking but have realized that the industry is already in place in more sophisticated environments who have adopted it, as it presents lesser risks, and morally displays ethical finance. They realized that they would be the wiser if they did not stand in the way of what the population wants.

The banking systems of the Horn of Africa States is bound to grow, and it would perhaps be good for them to consult with each other and create among themselves business relationships, if not merging with each other to take advantage of their mutual benefits. It is often said that the Horn of Africa represents a large consumer market with a present population of some 157 million people, which is expected to grow to 193 million by 2030, an annual growth of some 2.87%. It does represent a consumer market and a source of cheap labor for services, production and manufacturing as well as a source of raw materials for at least significant materials of high value such as oil and gas, copper, cobalt, gold, platinum, phosphates, and others. It enjoys large farmland spaces and plenty of water in addition to its long coast, rich in fish and other seafood, and of course minerals. The Blue economy of the region, if fully developed would be enormous.

All these offer foreign players and new entrants as well as existing domestic banks opportunities to invest and exploit and make above usual expected returns of normal markets, while providing employment to the huge youthful population of the region. The banking penetration of the market is low, and many other gaps remain such as access to finance for SMEs, women, and youth, who apparently, as was always the case, work with their wits and without nobody’s financial support, and this is the case, despite their participation in the labor market and private sector activity. There remain institutional weaknesses which need to be addressed including boosting access to SMEs and the low-income groups, which constitutes the majority of the population. One must note that reforms would be necessary to enhance financial literacy and improve SME governance structures and insolvency frameworks. Other reforms encouraging female and youth employment and the use of emerging technologies in finance would add onto the development of the financial sector.

Bob Parsons, the great American Entrepreneur and Billionaire, who founded GoDaddy and is currently CEO of YAM Worldwide, is noted to have said, “Let’s be honest. There’s not a business anywhere that is without problems. Business is complicated and imperfect. Every business everywhere is staffed with imperfect human beings and exists by providing a product or service to other imperfect human beings.” The Horn of Africa States is not a perfect place and doing business there, would not be easy, but with care and caution and adroit management, one would make significant wealth from the region.

“Not to unite is bad, not to want to unite is worse”

*Dr. Walhad writes on the Horn of Africa economies and politics. He can be reached at walhad@hornafric.org