Fasika Tadesse and Colleen Goko

Bloomberg Businessweek

Mon, December 25, 2023

Ethiopia became Africa’s latest defaulter after it failed to make an interest payment following the end of a grace period on Monday.

Ethiopia became Africa’s latest defaulter after it failed to make an interest payment following the end of a grace period on Monday.

The Horn of Africa nation had to pay a $33 million coupon on Dec. 11. The government didn’t want to make the payment because it “wants to treat all creditors in the same way,” Ahmed Shide, Ethiopia’s minister of finance said on state TV on Thursday.

Hinjat Shamil, senior reform advisor at the Ministry of Finance confirmed Monday that the payment had not, and will not be paid. Ethiopia reached an agreement with bilateral creditors last month to suspend debt payments.

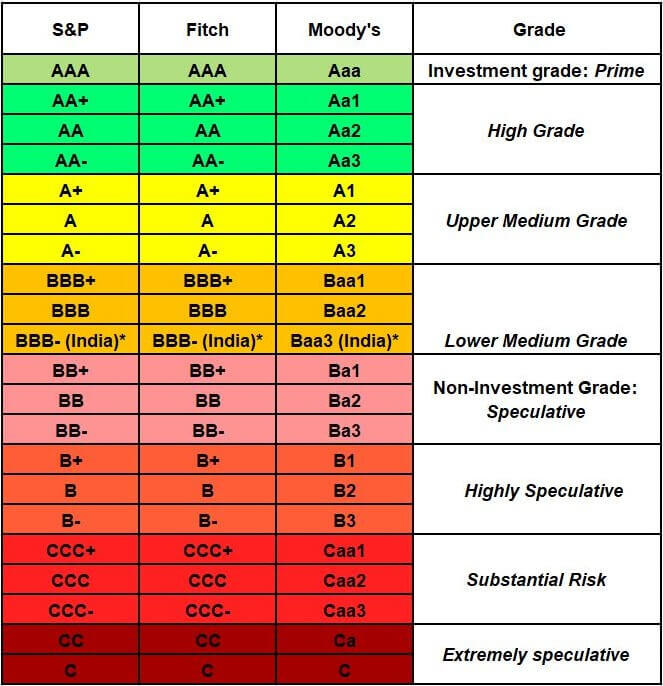

The default puts Ethiopia among a growing number of developing nations that have defaulted on Eurobonds in recent years, including Zambia, Ghana and Sri Lanka.

Read more: Ethiopia Says ‘Affordable’ Bond Payment Withheld on Equality

In its counterproposal for a restructuring, the government asked bondholders to extend the maturity to amortize from July 2028 through to January 2032, and to reduce the coupon to 5.5% from the current 6.625%. However, the face value is to remain at $1 billion, meaning creditors won’t need to swallow a so-called haircut on their holdings.

An ad hoc committee of bondholders earlier this month said it views the decision not to make the payment as “both unnecessary and unfortunate.”

Ethiopia is seeking to renegotiate its obligations through the Group of 20’s Common Framework, which has started to gain momentum after Zambia and Ghana made progress restructuring their debts. That allows debt relief from public as well as private lenders to be coordinated, to set debt treatment standards.

The nation reached an in-principle agreement with bilateral creditors to suspend debt payments, having sought to rework its liabilities since 2021 as a civil war in the northern Tigray region soured investor sentiment and sapped economic growth.

What I hedge my bet on is those very capable and qualified financial experts who are in charge of the ministries responsible in managing the economy of their country. For me they are not responsible for this failure to pay debts. Majority of countries that faced or currently facing the failure are those with runaway corruption that caused political instability and violence because of it. Ethiopia is one of those in the grip of the political mantle had a feast on the nations coffers in the most innovative ways. We have heard it all how that country was taken to the cleaners to the tune of 30 billion in US dollars in just a decade or so by those in charge of ruling the country and their cabals. Then those financials were asked to fix it. I said in the most innovative to describe the way the nation’s coffers were pilfered because I had challenged capable and qualified financial expert among us to trace and catch any of it. I have read stories of newly arrived ‘refugees’ buying grocery stores just a few months after they arrived here. It could be legit but to me it is a suspect. So my challenge to our experts is still alive. I dare you if you can catch one!!!

Ethiopia can’t pay its debts because of Abiy and co period! Abiy and co include the so called financial experts so spare us the deflection of blame or make it an all inclusive problem encompassing TPLF and whoever else. The current incompetent, illiterate, and blood thirsty idiots are driving the country into a deep pit of oblivion. All are “cheka ras ” compared to any past and possibly future Ethiopian government. They don’t even deserve to run their households much less a government. Fanno to the rescue!!!

Here you are. We, not directly involved with the talks about the payment, don’t know the details about it. We have no clue about what is going on behind the close doors between the lenders and indebted. This official, H.E. Ahmed Shide is an over qualified financial expert and is said to be surrounded by equally qualified experts. And it is not only Ethiopia but Ghana is also not budging to the terms and practices of the payment. They will make some rearrangements and we will never hear about it anymore.

Ok bigots! Stop dancing to this tune!!! Don’t lose your composure! Will you?