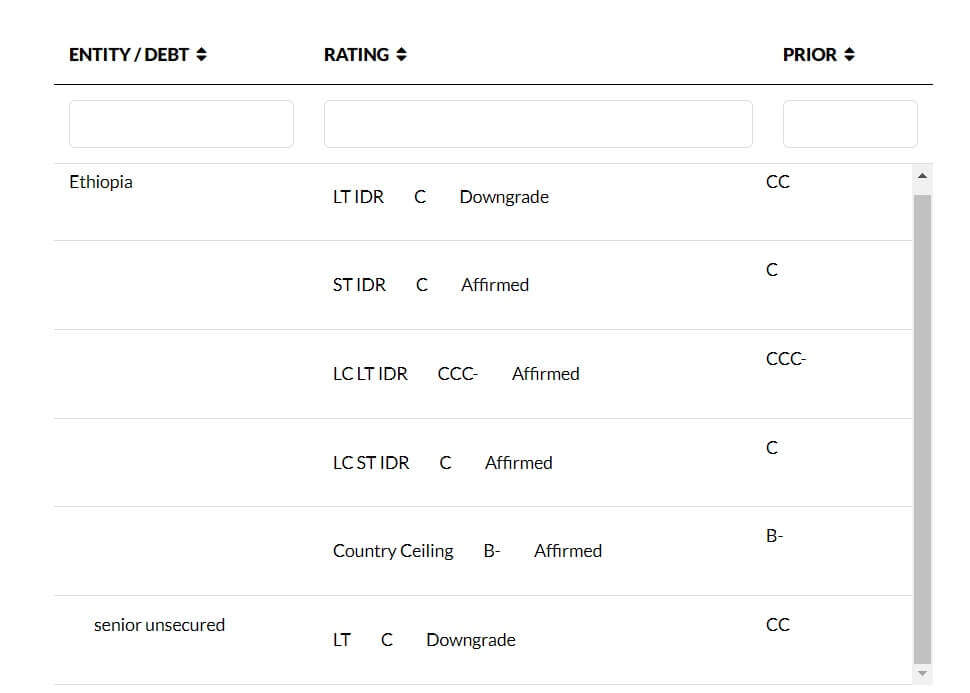

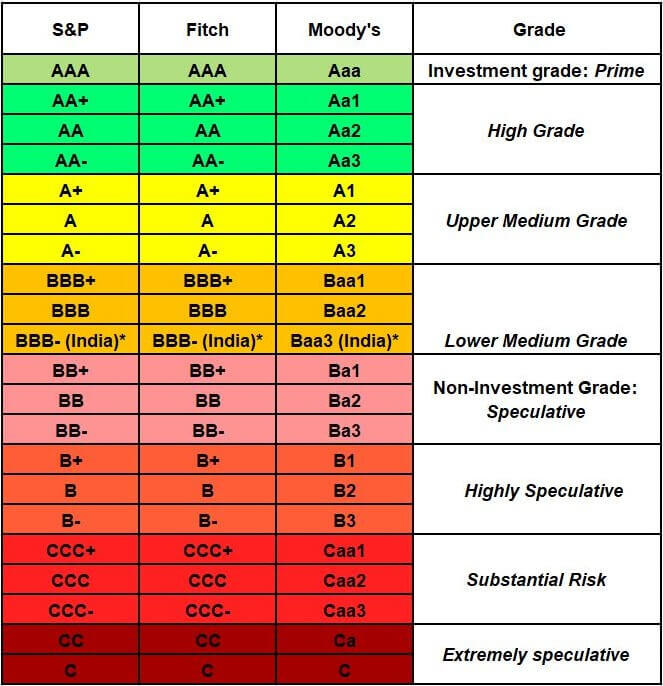

Fitch Ratings – Hong Kong – 14 Dec 2023: Fitch Ratings has downgraded Ethiopia’s Long-Term Foreign-Currency (LTFC) Issuer Default Rating (IDR) as well as the issue rating on Ethiopia’s single outstanding Eurobond to ‘C’ from ‘CC’. Fitch typically does not assign Outlooks to sovereigns with a rating of ‘CCC+’ or below.

A full list of rating actions is at the end of this rating action commentary.

KEY RATING DRIVERS

Missed Coupon Payment: The downgrade of Ethiopia’s LTFC IDR reflects Fitch’s understanding that the USD33 million coupon payment on Ethiopia’s single outstanding USD1 billion Eurobond, maturing in 2024, was not made by the due date on 11 December 2023. The government announced on 8 December that Ethiopia was not in a position to make the coupon payment. Fitch views the failure to make the coupon payment as the beginning of a sovereign default process and consistent with a ‘C’ rating. We will downgrade the LTFC IDR to ‘RD’ if the coupon payment is not made within the stipulated 14-day grace period.

Fitch downgraded Ethiopia’s LT FC IDR to ‘CC’ from ‘CCC-‘ on 2 November 2023 to reflect the increased likelihood of a default event amid the material decline in external liquidity, significant external financing gaps, and the government’s participation in the G20 Common Framework (CF) debt relief initiative, given the mechanism’s guiding principle of comparable treatment for official and private creditors.

Interim Bilateral Debt Service Suspension: In November, the government reached an agreement in principle with its official bilateral creditors on a suspension of debt service due from 1 January 2023 to 31 December 2024. The debt treatment applies to direct obligations or explicitly guaranteed debt of the Ethiopian government to all Official Credit Committee (OCC) members except for China. Ethiopia reached an agreement with China earlier. The OCC retains the right to suspend the agreement if Ethiopia does not secure an IMF programme by end-March 2024.

Official-sector debt treatment would not be judged a distressed debt exchange under Fitch’s sovereign rating criteria but official creditors may seek comparable treatment for private-creditor claims under the CF. Ethiopia failed to reach an agreement on debt suspension with Eurobond holders in meetings before the 8 December announcement but the government is set to launch further negotiations with bondholders on 14 December.

Local Currency IDR Affirmed: Fitch has affirmed the LT Local-Currency (LC) IDR at ‘CCC-‘ as the government has continued to service its LC debt and has made no indication that it plans to include domestic debt in any potential debt restructuring. However, the ‘CCC-‘ rating reflects the significant risk of default arising from heightened macroeconomic imbalances and liquidity strains.

ESG – Governance: Governance and Creditor Rights: Ethiopia has an ESG Relevance Score (RS) of ‘5’ for both Political Stability and Rights and for the Rule of Law, Institutional and Regulatory Quality and Control of Corruption. Theses scores reflect the high weight that the World Bank Governance Indicators (WBGI) have in our proprietary Sovereign Rating Model. Ethiopia has a low WBGI ranking at 21.6, reflecting the absence of a recent track record of peaceful political transitions, relatively weak rights for participation in the political process, weak institutional capacity, uneven application of the rule of law and a high level of corruption.

Ethiopia also has an ESG Relevance Score of ‘5’ for Creditor Rights, as willingness to service and repay debt is highly relevant to the rating, as for all sovereigns. The current rating action reflects Fitch’s view that a default event is imminent.

RATING SENSITIVITIES

Factors that Could, Individually or Collectively, Lead to Negative Rating Action/Downgrade

– Failure to make scheduled coupon payment within the grace period or completion of any debt exchange proposal that entails a distressed debt exchange would lead to a downgrade of Ethiopia’s LTFC IDR to ‘RD’.

– Stronger evidence that a default event under Fitch’s criteria on LC debt is probable would lead to a downgrade of Ethiopia’s LTLC IDR.

Factors that Could, Individually or Collectively, Lead to Positive Rating Action/Upgrade

Payment on upcoming commercial debt obligations and signs of improved capacity and willingness to continue to do so.

SOVEREIGN RATING MODEL (SRM) AND QUALITATIVE OVERLAY (QO)

Fitch’s proprietary SRM assigns Ethiopia a score equivalent to a rating of ‘B-‘ on the Long-Term Foreign-Currency IDR scale. However, in accordance with its rating criteria, Fitch’s sovereign rating committee has not utilised the SRM and QO to explain the ratings in this instance. Ratings of ‘CCC+’ and below are instead guided by the rating definitions.

Fitch’s SRM is the agency’s proprietary multiple regression rating model that employs 18 variables based on three-year centred averages, including one year of forecasts, to produce a score equivalent to a LT FC IDR. Fitch’s QO is a forward-looking qualitative framework designed to allow for adjustment to the SRM output to assign the final rating, reflecting factors within our criteria that are not fully quantifiable and/or not fully reflected in the SRM.

COUNTRY CEILING

The Country Ceiling for Ethiopia is ‘B-‘. For sovereigns rated ‘CCC+’ and below, Fitch assumes a starting point of ‘CCC+’ for determining the Country Ceiling. Fitch’s Country Ceiling Model produced a starting point uplift of 0 notches above the IDR. Fitch’s rating committee applied a +1 notch qualitative adjustment to the model result, under the Balance and Payments Restrictions pillar, reflecting our view that the private sector has not been prevented or significantly impeded from converting local currency into foreign currency and transferring the proceeds to non-resident creditors to service debt payments.

Fitch does not assign Country Ceilings below ‘CCC+’, and only assigns a Country Ceiling of ‘CCC+’ in the event that transfer and convertibility risk has materialised and is impacting the vast majority of economic sectors and asset classes.

REFERENCES FOR SUBSTANTIALLY MATERIAL SOURCE CITED AS KEY DRIVER OF RATING

The principal sources of information used in the analysis are described in the Applicable Criteria.

ESG CONSIDERATIONS

Ethiopia has an ESG Relevance Score of ‘5’ for Political Stability and Rights as World Bank Governance Indicators have the highest weight in Fitch’s SRM and are therefore highly relevant to the rating and a key rating driver with a high weight. As Ethiopia has a percentile rank below 50 for the respective Governance Indicator, this has a negative impact on the credit profile.

Ethiopia has an ESG Relevance Score of ‘5’ for Rule of Law, Institutional & Regulatory Quality and Control of Corruption as World Bank Governance Indicators have the highest weight in Fitch’s SRM and are therefore highly relevant to the rating and are a key rating driver with a high weight. As Ethiopia has a percentile rank below 50 for the respective Governance Indicators, this has a negative impact on the credit profile.

Ethiopia has an ESG Relevance Score of ‘5’ for Creditor Rights as willingness to service and repay debt is highly relevant to the rating, as for all sovereigns. Furthermore, Ethiopia faces an increasing possibility of default, as reflected in the ‘CC’ LTFC IDR.

Ethiopia has an ESG Relevance Score of ‘4’for Human Rights and Political Freedoms as the Voice and Accountability pillar of the World Bank Governance Indicators is relevant to the rating and a rating driver. As Ethiopia has a percentile rank below 50 for the respective Governance Indicator, this has a negative impact on the credit profile.

The highest level of ESG credit relevance is a score of ‘3’, unless otherwise disclosed in this section. A score of ‘3’ means ESG issues are credit-neutral or have only a minimal credit impact on the entity, either due to their nature or the way in which they are being managed by the entity. Fitch’s ESG Relevance Scores are not inputs in the rating process; they are an observation on the relevance and materiality of ESG factors in the rating decision. For more information on Fitch’s ESG Relevance Scores, visit www.fitchratings.com/topics/esg/products#esg-relevance-scores.