By Dr. Suleiman Walhad

(May 25th, 2022)

When we hear a bank, one normally immediately thinks of money stashed away in vaults, and where the privileged either store their money or withdraw from it. A bank is, indeed, “a financial intermediary that mobilizes Deposits from the general population, governments, and corporations and provides these funds to productive lending/investment activities in a society, country, region or even globally at times” (Putting Africa Back to Work – The Art of Nation Building, Dr. Suleiman Walhad, October 2017, p.127).

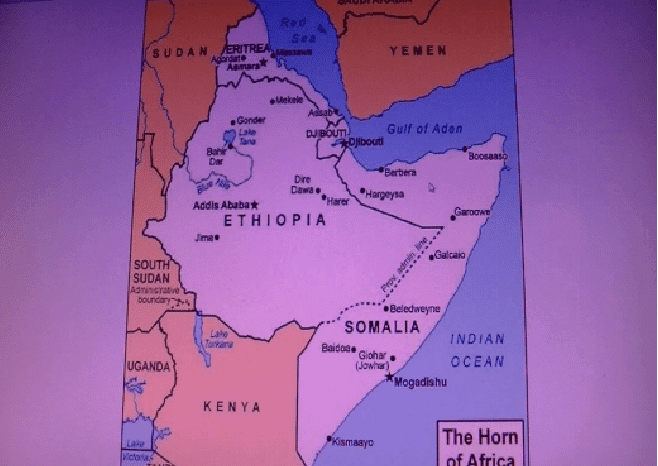

In the Horn of Africa, as it was in the rest of Africa, banking was introduced by the colonial administrations to serve their administrations and eventually the elites of the region or those who worked for the colonial administrations. It was not intended for the general population. When the colonials left, their burdens and privileges were inherited by the new governments of the region. The banks that were then in place continued their business serving the new government administrations and the elites of the countries of the region, and the general populations, as usual remained at the bottom of the stack. They do not know how a financial system works and how it can change the economy of a country. How could they understand, when they do not even understand how governments work and only see them on their clan/tribal prisms? This is how malicious politicians play the game of politics in the region – it is “us” against all the other clans/tribes!!!!

Human activities of today require capital and if this is deprived from it, it remains like a still-born baby, no matter how good or resourceful it is. Every society generally comprises three groups, namely, the elite or higher-income group, the middle-income group and the lower-income group. Generally, the higher-income group is small and narrow, the middle-income group is wider and more the elites and the lower-income is bulgy and the largest of the three.

The lower-income group in Africa and in the Horn of Africa are not generally served by the financial systems or the banks. Banks in the region generally serve the elite and the middle-income groups and the governments. The lower-income group, despite being the largest segment of the population, is not served and therefore remain economically small and stunted and does not contribute to the general wellbeing of the economy, as it should.

Money is generally scattered in the population. One person cannot create a large corporation alone, although there may always be exceptions. The small funds scattered in the population can be collected by an entity, we call a bank and can be invested collectively by the bank in a profitable venture. This means, banks enabled by the collection of the scattered funds in the population, can finance the small and medium sized companies of the region. The Horn of Africans only came to know of this late and realized that they can, indeed, collect funds and outlay it in profitable ventures and they hence established private banks, although the major junk of financial transactions still remains in the hands of governments, explaining why politicians fight over the governance of the countries. This would continue to be so in the future.

Governments raise funds to finance these transactions through a number of ways, the first being taxes on the population and corporates. They could be taxes on incomes, taxes on goods and services or taxes on properties. Governments can also receive aid and grants from other governments or other multi-lateral organizations, or they can borrow funds from banks, both local and international. In the Horn of Africa States, it would appear that most government incomes come from taxes and aid/grants from others. Extraordinarily little is received in terms of loans from international banks because of the perceived high risks associated with the region, and the domestic banks mistrust governments, because of the local governance issues. Accordingly, the biggest pie in the economic system of the country, namely the government transactions, remains growing at a slow pace, well below what the economy should have been doing.

The contribution of the private sector also remains small, for many of them, invest in projects that do not contribute to the income generation of the economy or its growth. One would normally see private investments in properties and service industries such as hoteliers that undercut each other. They do not invest in industries that add on to further production processes and hence expansion of the economy. The banking and financial system, thus, generally remain, insignificant in the economic systems and hence need full reformation.

The banking system of the Horn of Africa States is definitely growing, although still small, unlike other regions of Africa, but their focus remains hazy. It is not directionally guided and appears to be competing with each other on ethnic basis. One sees a bank that serves this community or that, and that is what is not required in the region, which needs an industry geared towards, development of not only the private sector (tourism, blue economy, transportation, manufacturing, etc.) but also enabling the governments to draw from the pool of funds available in the country, instead of extending its hands to others for external aid or even borrowing from multi-laterals who, at the end of the day, are serving others.

A most crucial factor for reforming the banking system in the region is reforming the legal system, which should be able to protect the rights of any party entering into a contractual obligation as it should also clarify the obligations of parties in a contract. Such rights and obligations should be made enforceable. This enables parties to enter into longer term workable contracts, which are inheritable by successors or inheritors with ease. These matters to date remain hazy and mostly rely on old traditions that may not hold well in a modern thriving society that is exposed to more risks that have not been digested by the public yet.

The reform process would also entail customer advocacy, so customers know their rights and obligations social responsibility such that banks know of their responsibilities towards the society such as environmental protection, labor rights and obligations, assisting the communities from which they draw most of their incomes. Those who draw benefits from the banking and financial system should not see the systems as milk cows only. A milk cow needs to be fed and watered and its health protected and so do banks. Those who are milking the cow i.e., the bank should, in their turn, must meet their obligations when they become due, deposit their surplus funds with the bank, attract others to the bank and provide other avenues where they can work together.

A major element in the local banking system is to enable them to provide funding for long term projects of the government such as roads, rail and other infrastructures. The banks should be comfortable by law that their rights would be protected by the government institutions from one administration to another, as administrations may change from time to time, through elections or otherwise. In effect, the banking system needs to be able to finance major projects over long term within the countries or the region. This would be beneficial not only for the business development of the region but would also assist the governments conduct their programs with ease. They would not be taking longer time to convince other non-regional financial institutions to provide funding for projects, as local banks are more versant on local conditions.

The local banking and finance institutions should provide funding for small and medium enterprises, which by far are the largest employers in the societies of the Horn of Africa States. At present these SMEs work with their wits and do not seek financial support from the banking system. It is where the banks are supposed to develop systems and processes that enable them to collaborate with them. Both the banks and SMEs would benefit from the relationship. The banks would make more profits while the SMEs would have reliable financial support when in need and the banking system would generally benefit from the multiplier effect. It is often said that the more the banks lend, the more profit they get, and the more money that begins to swish around in the economy. Financing SMEs is generally short term, with few in the medium term. This enables the circulation of the money in the economic system faster and wider.

Where do we need financing in the Horn of Africa States? There is need for financing in agriculture, fishing, small scale industries, the food processing industries, restaurants, shops, coffee shops, barbers, repair shops and garages and all the plethora of small businesses that would not need huge outlays of monies to operate. This would disperse the risks in terms of number of obligors and would also reduce the time risk of exposures.

A further element that would be needed to be reformed is the literacy of the general population on banking. Once the SMEs are financed and become part of the banking and financial system, their knowledge of the system and those of the general population, would increase and hence their importance for the general wellbeing of the society. It is important that the banking system and their regulators encourage the SMEs to use the resources of the banks and finance institutions and participate in enlarging the financial and economic pie.

It will be important to have the regulators discourage the banking system deploy speculatory products being sold to the unsuspecting investors in the region, for they entail huge risks which the financial systems of the region may not be able to manage or absorb. Primacy should always be given to the common good of society.

One more step in the process of reforming the banking and finance system of the Horn of Africa States is to allow them to operate across the borders of the member states so that services may be provided by the total banking system of the region and not caged in specific countries as is the case today. A bank in Djibouti should be able to open branches in any of the member countries with less formalities than is the case today and so should all the other banks in each of the other members open branches in each of the other member countries of the region. This would create a large workable market that can learn from each other and compliment each other or even merge with each other.

Currently, there are no lobbyists for the banking and finance industries of the region with the governments of the region. Maybe it is high time that the banking and finance systems created a common association with a seat in one of the countries and which helped the governments of the region implement certain rules and regulations that are beneficial for the industry in the region. The region must aim at a banking and finance system that serves the real economy, social justice, crisis prevention and financial stability. These are all doable, for other markets have suffered from them before and the region should learn from those mistakes and not repeat them in the creation of new regional banking and finance system.

As Somalis say, “ Lost time is never found again” as time is money and when one mismanages one’s time, one’s business bleeds. It is never recovered again. Reforming the banking and finance process in the Horn of Africa States, is an activity whose time has come. It should not be put off for another day. Let us follow the Yoruba custom of: “The soup the master of the house does not eat, the woman of the house does not prepare”. It literally means Listen to your customers. Give your customers exactly what they want, how they want it, when they want it. The customer is king! The populations of the region do not want to be caged. They want to work together and cross borders with their goods and services, with ease. The governments must play their part in the process.

“Not to unite is bad, not to want to unite is worse”

*Dr. Walhad writes on the Horn of Africa economies and politics. He can be reached at walhad@hornafric.org

Another article that has loads of meat by the dear author. Keep writing, sir!!!