By

Dr. Suleiman walhad

May 30th, 2022

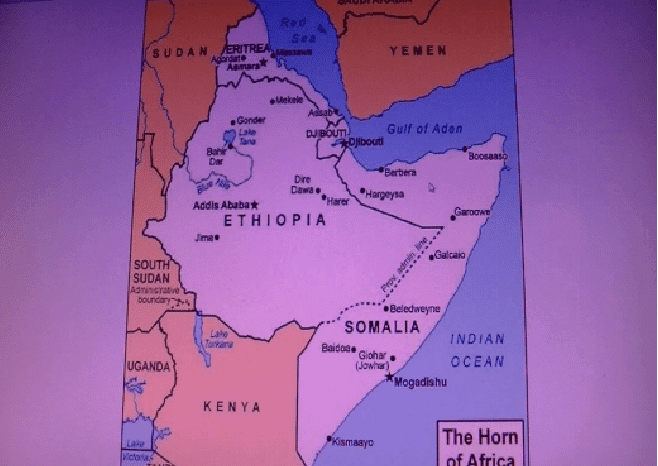

A financial infrastructure is generally the foundation of a financial system including the institutions, information, technologies and rules and standards which enable financial activities including financial intermediation. In the Horn of Africa States, the financial sector is simply seen as an instrument to finance other key economic sectors such as small-scale industries, agriculture, fishing, real estate and others, i.e., the real economy. It still remains the main engine that governments of the region use to provide allocation of funds from its taxation revenues and foreign aid and/or grants that balance their payment deficits, to economic sectors .

The financial system is not seen as an economic sector itself that can add on to the economic pie and growth of the member countries, for there is no regional infrastructure as yet in the region. Each country relies on its own financial institutions as regulated and guided by the individual central banks. In many other jurisdictions and mostly in the developed world, and now countries like West Asia (Gulf Arab Co-operation Council) did realize and now use their financial infrastructures as an instrument that helps economic growth. Financial markets play significant roles in:

(a) increasing savings in a society

(b) efficient allocating investment resources

(c) utilizing existing resources more efficiently.

The financial system and infrastructure in the Horn of Africa States remain under the control of the governments through the central banks and the banks and financial institutions draw their well being from their linkages to the central banks. They do not see themselves as efficient organizations that can add on to the economic pie but simply as service organizations that facilitate the requirements of the real economy.

A world bank report of 1989, stated that, “It became widely acknowledged that economic growth without well-developed domestic financial markets would be detrimental to the longer run growth prospects of developing countries.”

A Global financial architecture was outlined in the Bretton Woods arrangements, agreed upon by the then powerful winning countries after the Second World War and generally also accepted by the weaker countries of the time. It was based on governmental decision-making processes, related to exchange rate regimes, balance of payments adjustment processes, international liquidity creation, and payments arrangements. All involved significant measures of government management. Exchange rates were fixed and could only be changed through intergovernmental agreements. Balance of payments adjustments was managed through domestic demand to ensure a stable current account, and international liquidity was based on the fixed dollar price of gold, until 1971. Liquidity creation was debated and discussed in international forums while capital account payments were in most countries subject to exchange controls.

This has, overtime, moved to market-oriented processes as liberalization of economies and in particular capital markets ascended over government managed economies. The gold connection of the US Dollar was discontinued in 1971 by the Nixon Administration, when the United States was almost bankrupt and could not continue to support the Gold-Dollar parity. It was when the Petro-dollar came into being as the United States and the Kingdom of Saudi Arabia agreed upon, at the request of the USA, that all petroleum products out of Saudi Arabia be sold in United States Dollars, hence giving the American currency the ability to continue its supremacy over all other currencies of the world, as the currency which is used for payments related to the largest commodity traded in world markets, petroleum and related products.

Cross border capital flows expanded through the liberalization processes and consequently financial market players grew in size and geographical spread, almost smashing national borders and hence developed a market driven international financial system. How this has affected the world is a wide subject and is not the intention of the article. We will address, however, how this has been a major factor in the financial and economic systems of the Horn of Africa States in the past and its future perspectives.

The Horn of Africa States region is generally a poor region, and its financial systems are small. Generally, it was government owned for most of the past half a century and more and accordingly liberalized economies and market systems were inexistent. The exchange regimes were government controlled and balance of payment processes and adjustments were always weak, requiring others to assist and support. The banking and financial systems still remain rudimentary and did not contribute much to the economic pie. They remained as treasury houses for the governments, where only government authorized foreign currency payments were made to meet the imports of the member countries. The export earnings were not sufficient to meet the import bills, which were mostly arms and weapons that were simply no more than consumer goods for the military that could not produce anything and once used could never come back to the economy.

Thus, the financial infrastructure of the region was far short of the global financial infrastructure and remained insignificant, not affecting or participating in its changing forms and environment. The world Bank and its sister company the IMF, were mostly supporting organizations and the financial systems of the countries of the region were never in a position to challenge their offers. When does a beggar question the hand that feeds him? Finance ministries dominated the financial systems of the region, as was envisaged in the architecture of the World Bank and the IMF, who wield influence aplenty on the central banks of the region.

Where well-developed domestic financial markets do not exist and where governments see themselves as the only guarantors of the economic pie and its growth, it does not augur well for the general wellbeing of the region and hence denies the contribution that a developed financial markets infrastructure would make. The Horn of Africa States region requires sizeable amounts of funds to finance the required critical infrastructures that steer a developing economy such as energy, water, roads and rail, shipping, airports and seaports, vast agricultural output not only to feed the growing population of the region but also to feed the neighboring water-short countries like West Asia.

It is important for the leadership of the region to realize that instead of emphasizing on foreign aid like many other African countries, they should develop the financial infrastructure of the region, which would in turn create linkages with other financial systems of the world and together finance the huge capital outlay required by the region for its development . It would be much easier than relying on foreign government aid and grants only, for all those countries extending the meager grants and financial support do not do so without ulterior motives. They must be protecting some interests whatever that maybe. There is no free economic pie!

The leadership of the region can do one thing, though, and that is, that it is important to realize that the financial systems of the region and those of other regions can participate in the developmental process of the region. However, it would be important to ensure that the rights of parties in financial obligations are protected. The legal systems must be developed to be in line with those of the international markets, such as those of England or New York or Paris or Frankfurt and others, where the rights and obligations of any party investing through the financial system is protected and where the leadership and its citizenry must abide by the law. It is a prime requirement for the development of the financial sector. The region should look into neighboring Dubai and how its has developed its financial and legal infrastructure, which are together helping the small phoenix state of Arabia Felix attract large investments from the river of funds that circulate the world.

The Horn of Africa States is generally marked by a large informal economy and informal economic actors. It is further marked by low savings , limited access to banks and weak regulatory regimes. It is where the region’s leadership needs to work upon and improve in order to develop its financial markets and even attract others. They need not extend their hands to other governments all the time! There is a general rule in finance, which says that money has no borders. It goes where it feels safe and can make more money. Why shouldn’t the Horn of Africa States become a safe haven for money and develop their financial markets to enable them have access to the funding requirements it needs for its development.

We generally note that the World Bank and the IMF are always involved in the poverty of the region and the inability of its leadership to figure out ways out of the recurring mess of droughts, conflicts, and shouting off their mouths on seeking help for this impoverished region. Is the region really impoverished? There is plenty of natural resources available and why shouldn’t the leadership allow those who have the possibilities (technically and financially) to exploit these resources under certain conditions that would help employment and provide training for the burgeoning youth population, be it foreign financial institutions or domestic.

It all depends on being wise and follow the route to development through the financial markets and the skills it entails. The leadership must create an enabling environment to attract the private sector investors in addition to foreign governments and multi-lateral governmental institutions. The attracted resources and domestic resources should be directed towards priority sectors such as infrastructure and quality education and health services, which will also further attract foreign skills to add on to the domestic labor force, if the skills for a particular industry/project are not available. The economic sector of the region should not be dependent on one or even few products that are needed by foreign markets only, but also cover domestic requirements and, in the main, food items for the growing population of the region. We must underscore the current food crisis of the world resulting from the Ukraine conflict, where some countries are already hinting on retaining their food production for domestic usage only and/or where it is logistically difficult to import food items. India is one such country in the news!

It is generally reported that the region is a potentially large producer of oil and gas, but the troubles of the region in the form of clan/tribal or generally ethnic conflicts do not encourage any investor venture into the region. This is an industry that requires large investment outlays and, sometimes, one must ask oneself, if the world would move on to other more efficient and environmentally friendly sources of energy before the region takes advantage of this substantial wealth in its lands and seas. A more sensible approach on the part of the leadership of the region (both the governing parties and the opposition) should be adopted where economic development is not jeopardized by political issues that can be settled through the art of consensus and compromise, instead of being at each others’ throats all the time.

The leadership should also take into consideration that it is not only necessary to attract foreign capital through efficient legal and administrative structures, but also to retain domestic funds fleeing the region to other parts of the world. There are no general statistics on this matter, but certainly large amounts of domestic regional funds are lost every year, even to closer regions like the East Africa Community or the SADC. One would probably be aware of the large Somali investments in Nairobi, which practically owns the city’s skyline. The region must be able to retain these sizeable funds being siphoned off because of the safety issues and/or underdeveloped backward legal systems, which do not protect the individual rights or investor rights.

“It is no disgrace at all to work for money and If people support each other, they do not fall”

*Dr. Walhad writes on the Horn of Africa economies and politics. He can be reached at walhad@hornafric.org

As always I enjoy reading the articles penned by our countryman Dr.Walhad. He always tends more to his trade he knows best and not dwelling too much on the politics of it. Keep writing sir!!!