September 10, 2025

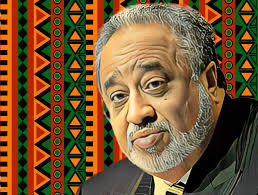

Mohammed Al Amoudi backs the Ethiopian economy in a big way. Often called the richest in Ethiopia and a global billionaire, he was born in Ethiopia, lived in Saudi Arabia, and invested across many sectors that matter to everyday people.

From gold and construction to hotels, energy, agriculture, and education, his companies create jobs and build infrastructure. He is also known for supporting the GERD initiative, a symbol of national progress. If you want clear facts on his investments, impact, and how they shape industries, you’re in the right place. This guide will show where the money goes, what results it brings, and why many say his role is positive for growth in Ethiopia — and why it matters to Mohammed Al Amoudi.

Early Life and Background

Birth and Family Origins

Birth and family origins are very important in understanding a person’s background. Mohammed Hussein Al Amoudi was born in Dessie, a city in Ethiopia, in 1946. His father was of Saudi descent, while his mother was Ethiopian. This mix of cultures shaped his unique identity from a young age. Growing up, Al Amoudi was surrounded by two rich traditions. His Ethiopian roots connected him to the Horn of Africa, while his Saudi heritage linked him to the Arabian Peninsula. These origins helped build the foundation of his values and worldview.

Dual Nationality and Cultural Heritage

Dual nationality and cultural heritage play a big role in Al Amoudi’s story. He is known for having both Ethiopian and Saudi identities. This dual nationality not only gave him a wide network but also allowed him to move and work in both countries easily. Al Amoudi’s cultural heritage is reflected in his business ventures and personal life, blending Ethiopian warmth and Saudi determination. He respects the history and traditions of both nations, which is visible in his philanthropy and investments. His ability to bridge two cultures has brought opportunities and a global perspective throughout his life.

Move to Saudi Arabia and Citizenship

Move to Saudi Arabia and citizenship became a turning point for Al Amoudi. As a young man, he relocated to Saudi Arabia with his family. This move opened doors for him in the business world. In the Kingdom, he received Saudi citizenship, further cementing his place in both countries. Having citizenship in Saudi Arabia allowed him to invest in major projects and build deep connections in the region. His time in Saudi Arabia expanded his business knowledge and provided him with the tools to become an international entrepreneur. The move was key in shaping his journey towards future success.

Rise to Billionaire Status

Major Milestones in Wealth Accumulation

Major milestones in wealth accumulation for Mohammed Hussein Al Amoudi started with his early move into construction and real estate. In the late 1970s and early 1980s, Al Amoudi took on major construction contracts, which became the pillar of his wealth. According to Forbes and his Wikipedia biography, his initial breakthroughs came from lucrative contracts in Saudi Arabia, where he managed large-scale infrastructure and government projects. These contracts provided a solid foundation for future endeavors.

Key construction projects led to Al Amoudi founding and expanding construction-related companies, such as the MIDROC Group. But Al Amoudi did not stop at construction. His next big milestone was branching out internationally, especially into the oil and energy sector. He acquired and operated oil refineries in Sweden (Preem) and Morocco, establishing himself as a global player in energy. Buying these established assets allowed him to tap into the profitable European oil market and diversify his investments.

Al Amoudi’s investments also expanded into agriculture, hotels, and mining. Yet, the real boost to his billionaire status came from his oil ventures. By owning Preem, which became Sweden’s largest oil refiner, and Svenska Petroleum Exploration, he ensured steady revenue streams even during market uncertainties. His ability to spot and act on promising investments proved vital, assisting him in reaching billionaire status by the early 2000s.

Key Construction Contracts and Oil Ventures

Key construction contracts in Saudi Arabia were central to Al Amoudi’s early success. He managed massive public works projects, including significant infrastructure developments and government-funded buildings. These contracts provided the capital needed to branch out into other sectors.

His oil ventures changed his wealth trajectory. In the 1990s and early 2000s, Al Amoudi purchased Preem Oil in Sweden. This bold move made his company Sweden’s largest private sector oil refiner. Similarly, securing Svenska Petroleum Exploration solidified his footprint in the oil market, while investments in Morocco’s refineries gave him further control over energy distribution in multiple regions.

Al Amoudi’s business interests went beyond oil with major investments in gold mining in Ethiopia, which complemented his wealth strategy. His approach was to integrate his investments so that successes in one sector could support growth in another, demonstrating full use of diversified risk and opportunity.

International Recognition and Net Worth Rankings

International recognition followed swiftly after Al Amoudi’s business expansion. Forbes listed him as one of the world’s 100 richest people from 2006 onwards. By 2015, he was ranked as the 82nd richest person globally, and often cited as the richest Ethiopian-born billionaire. Valid as of 2025, sources like Bloomberg and Forbes estimate his net worth between $8 and $14 billion depending on market conditions, mainly affected by fluctuations in oil and gold prices.

Ranking as the second-richest Saudi citizen and consistently among the wealthiest Arabs globally, Al Amoudi has become a symbol of successful African and Middle Eastern entrepreneurship. His rise to international fame is not only because of his vast wealth but also due to his strong impact in multiple sectors. He has received honors and awards for his contributions to business, philanthropy, and developing economies, making him a recognized leader on the world stage.

His story is now often cited as a classic example of smart investment, cross-sector vision, and leveraging regional opportunities for global success.

Overview of Core Holdings

Mohammed Al-Amoudi’s business empire is one of the most diverse and influential in Africa and beyond. His wealth and influence come from two core holding groups: MIDROC Investment Group and Corral Petroleum Holdings. These holding companies span industries such as construction, agriculture, energy, mining, real estate, healthcare, and manufacturing. MIDROC Investment Group acts as the umbrella for a host of businesses in Ethiopia, while Corral Petroleum Holdings manages international energy assets, especially in Sweden. Together, these holdings have made Al-Amoudi a global business icon, controlling dozens of major companies and employing tens of thousands across several continents.

MIDROC Investment Group

MIDROC Investment Group is the crown jewel of Al-Amoudi’s operations in Ethiopia and Africa. Founded in 1994, it stands for Mohammed International Development Research and Organization Companies. MIDROC operates mainly in Ethiopia but also in Europe and the Middle East. The group has diversified investments, including mining (gold, tantalum, marble), agriculture, manufacturing, construction, hotels, healthcare, energy, and more. MIDROC’s clusters manage core sectors ranging from agro-processing to large-scale industrial operations and technology. With more than 40 member companies, it is the largest private investment group in Ethiopia and employs over 10,000 people. MIDROC’s reach means that it plays a key role in Ethiopia’s overall economic development and industrialization.

Corral Petroleum Holdings

Corral Petroleum Holdings is Al-Amoudi’s international investment arm, originally based in Sweden. Through this company, he held majority ownership over some of Europe’s largest energy firms. Corral Petroleum Holdings’ most important subsidiary was Preem, Sweden’s largest oil refinery and fuel company. The company also owned Svenska Petroleum Exploration, which managed exploration and production of oil and gas. Corral Petroleum Holdings has constantly been in the headlines for transformative deals, including the recent multi-billion-dollar sale of Preem and Svenska Petroleum Exploration, signaling strategic pivots in the billionaire’s holdings. Even after these sales, Corral remains a symbol of Al-Amoudi’s influence in the energy sector.

Global Investments and Workforce Impact

Al-Amoudi’s global investments reach across three continents: Europe, Africa, and the Middle East. The influence of his companies is enormous. At its height, his empire directly employed more than 70,000 people in industries like construction, oil & gas, mining, agriculture, food processing, healthcare, and hospitality. His investments have boosted regional economies in Ethiopia, Saudi Arabia, Sweden, and beyond. In Ethiopia, he is the largest private investor, responsible for thousands of direct and indirect jobs. His holdings in Sweden and elsewhere helped modernize refineries and ensure regional energy supply. Al-Amoudi’s businesses are credited with developing skills, improving technology, and lifting many Ethiopian families out of poverty by providing stable employment and community services.

Key Companies and Assets

Preem Oil (Sweden)

Preem Oil was the most significant energy asset under Al-Amoudi’s control via Corral Petroleum Holdings. Based in Sweden, Preem is the country’s largest oil refiner and fuel distributor. The company was acquired in 1994 and remained under Al-Amoudi’s leadership until its sale in 2025. Preem operated two major refineries, contributing to 80 percent of Sweden’s refining capacity and employing thousands. It played a pivotal role in the Northern European energy market and was at the forefront of sustainable fuel research, working to transition to greener energy sources.

Svenska Petroleum Exploration

Svenska Petroleum Exploration is another major asset that was wholly owned, through Petroswede AB and ultimately Corral Holdings. This company explored and produced oil and gas, operating in Africa and Europe. Al-Amoudi’s ownership propelled Svenska to great success in oil exploration, with operations in West Africa being especially valuable. In early 2024, Al-Amoudi completed the sale of Svenska Petroleum Exploration in a deal that added over $2 billion to his fortune, showing his ability to pivot and diversify his holdings even in rapidly changing energy markets.

MIDROC Gold (Ethiopia)

MIDROC Gold is the largest private gold mining company in Ethiopia, operating the Lega Dembi and Sakaro mines. Acquired after privatization in the 1990s, MIDROC Gold is a vital part of Ethiopia’s mining sector and foreign exchange earnings. It employs hundreds, supports local infrastructure, and contributes significantly to national revenue. The company continues to explore and develop new reserves, maintaining Ethiopia’s place on the map as a global gold producer.

Saudi Star Agricultural Development Plc

Saudi Star Agricultural Development Plc is a flagship agribusiness under Al-Amoudi’s MIDROC Group. It was established to support Saudi Arabia’s King Abdullah Food Security Program by producing rice, sugar, and other crops in Ethiopia’s fertile Gambela region. Saudi Star leases tens of thousands of hectares of farmland and has attracted attention for large-scale irrigation, modern farming technology, and its focus on food security. The company has announced plans for multi-billion-dollar investments, aiming to be a leading exporter of food crops from Africa to the Middle East and beyond.

Okote Gold and Large-Scale Gold Mining

Okote Gold represents another major mining venture within the MIDROC empire. The Okote site in Ethiopia’s Oromia region is believed to hold over 500 tons of gold, making it a potentially massive reserve for future development. While not yet in full-scale production, Okote is valued at close to $1 billion and is a symbol of Al-Amoudi’s focus on large-scale resource projects in Ethiopia, ensuring significant revenue and employment for the country in the future.

The story of Al-Amoudi’s business empire is not just about wealth. It is about economic impact, innovation, and transformation across continents. His companies shape industries, create jobs, and export Ethiopian potential to the world.

Major Investments in Ethiopia

Agriculture and Food Security

Modern Farming and Land Development

Major investments in Ethiopia by billionaire Mohammed Al Amoudi have greatly transformed the country’s agriculture and food security. Modern farming and land development projects have been a top priority for his companies. Through Saudi Star Agricultural Development Plc, Al Amoudi has introduced state-of-the-art irrigation systems, mechanized plowing, and crop management techniques on tens of thousands of hectares. These improvements have helped turn vast stretches of previously underutilized land into productive farmland, supporting both local food needs and export goals. Locals have received agricultural training, boosting crop yields and creating new jobs.

Sugar, Grains, Coffee, and Rice Initiatives

Sugar, grains, coffee, and rice initiatives are a central part of Al Amoudi’s vision for agriculture in Ethiopia. Saudi Star aims to make Ethiopia a leading exporter of rice by cultivating huge rice fields in the Gambella region. Additionally, investments in sugar processing plants, wheat farms, and coffee plantations have created a stronger and more resilient food supply chain. These projects not only help reduce food imports but also give Ethiopian produce a global platform. Coffee, being Ethiopia’s signature crop, benefits from modern processing and marketing, increasing its value and reputation worldwide.

Mining and Natural Resources

Gold Exportation and Processing

Major investments in gold exportation and processing have placed Ethiopia on the international map. Through MIDROC Gold, Mohammed Al Amoudi oversees some of the largest gold mining operations in East Africa. The company has modernized gold extraction, refining, and export procedures. Gold produced is a key export and generates vital foreign currency for Ethiopia. Local processing plants also add value and reduce dependency on raw exports.

MIDROC Gold Mine and National Impact

The MIDROC Gold Mine is one of Ethiopia’s largest private sector employers. Its national impact is significant. The mine has funded infrastructure projects, new schools, and health centers in mining areas. Revenues from gold exports have increased national reserves, stabilized the local economy, and made Ethiopia more attractive to global investors. Efforts to meet international mining standards have also enhanced Ethiopia’s reputation as a mining destination.

Real Estate and Construction

Infrastructure Projects

Infrastructure projects led by Al Amoudi’s companies have included roads, bridges, and water treatment plants. These initiatives have improved transport links between cities and rural areas, helping people access jobs, markets, and social services. Many construction activities are tied to major government projects, enhancing the nation’s growth potential and living standards.

Steel and Cement Production

Steel and cement production have seen major boosts thanks to investments by MIDROC and its subsidiaries. Local factories reduce Ethiopia’s reliance on imported materials, cut construction costs, and speed up development. The production of quality steel and cement supports Ethiopia’s many ongoing infrastructure projects, from housing to factories and highways.

Hospitality and Tourism

Sheraton Addis Development

The Sheraton Addis hotel, one of the most luxurious in Africa, is a flagship hospitality venture in Ethiopia. Al Amoudi’s investment has set new standards for service and quality, attracting international guests and events. The Sheraton is a key venue for business summits, official functions, and high-profile tourists. It contributes significantly to the country’s tourism brand and provides hundreds of local jobs.

Real Estate Contributions

Real estate contributions extend beyond the hospitality sector. MIDROC has developed residential communities, retail centers, and office complexes in and around Addis Ababa. These projects cater to growing urban populations and meet demands for modern living and working spaces. By investing in both affordable and luxury segments, MIDROC supports Ethiopia’s rapid urbanization and improves the quality of life for many families.

Aviation and Transportation

Trans Nation Airways

Trans Nation Airways, owned by Al Amoudi’s investment group, supports Ethiopia’s growing aviation industry. It offers cargo and passenger services domestically and to nearby countries, making travel and logistics faster and more reliable. Modern planes and skilled staff help set new standards for regional aviation. This investment is vital for business, trade, and tourism, linking Ethiopia with global destinations.

Other Industrial Sectors

Healthcare and Medical Facilities

Healthcare and medical facilities benefit from Al Amoudi’s focus on social impact. Investments include building state-of-the-art hospitals, clinics, and diagnostic centers in major cities. These facilities provide affordable, high-quality healthcare to thousands of Ethiopians. Special programs support maternal health, chronic disease care, and emergency response.

Manufacturing and Industrial Growth

Manufacturing and industrial growth have been accelerated by a wave of new factories producing everything from consumer goods to building materials. Jobs are created for skilled and unskilled workers, and the local economy gets a boost from value-added processing. MIDROC’s investments also encourage smaller businesses to join supply chains, helping drive Ethiopia’s push towards becoming an African manufacturing hub.

Economic Impact on Ethiopia

Job Creation and Employment

Job creation and employment are among the most important contributions made by Sheikh Mohammed Al Amoudi to Ethiopia’s economy. Through his companies such as MIDROC Gold, Saudi Star Agricultural Development, and various construction, mining, and hospitality ventures, he has provided jobs for tens of thousands of Ethiopians. The MIDROC investment group alone is known for directly employing more than 70,000 people, while thousands more benefit from indirect job opportunities as suppliers, service providers, and subcontractors. From gold miners in Oromia to rice farmers in Gambella and hotel staff in Addis Ababa, his diverse investments create steady incomes for families across the country.

Jobs provided by Al Amoudi’s enterprises often come with professional training and skill development. For example, MIDROC Gold employees receive technical education in mining operations, while Sheraton Addis staff are trained in world-class hotel management. These opportunities improve the long-term prospects for Ethiopia’s workforce and help reduce poverty, especially in rural areas.

Contribution to National GDP

Contribution to national GDP is another vital area where Sheikh Mohammed Al Amoudi stands out. His businesses have become pillars of Ethiopia’s economy, especially in sectors like agriculture, mining, construction, and manufacturing. MIDROC Gold, as Ethiopia’s biggest gold exporter, brings in significant foreign currency that directly contributes to government revenues and supports economic stability. Saudi Star’s large-scale agricultural projects enhance food production and reduce the need for imports, further helping the national balance sheet.

The overall value generated by Al Amoudi’s investments is estimated to account for several percentage points of Ethiopia’s entire GDP. Studies and local reports often note that during years of peak performance, the gold sector alone contributed about 2 percent to the GDP, much of it linked to MIDROC’s operations. His companies also pay substantial taxes, royalties, and export duties, directly feeding into Ethiopia’s development budget.

Infrastructure and Modernization Efforts

Infrastructure and modernization efforts in Ethiopia have been strongly supported by Al Amoudi’s vision and capital. MIDROC and related firms have constructed important roads, factories, bridges, industrial parks, and electricity plants across the nation. The Sheraton Addis, for instance, is not only a luxury hotel but also a symbol of modern construction standards in Ethiopia.

Major infrastructure projects such as cement and steel plants, developed by Al Amoudi’s companies, have enabled faster building of roads, housing, schools, and hospitals throughout Ethiopia. Such developments boost local economies, encourage foreign investors, and provide essential services to millions of Ethiopians. The ripple effects of these projects reach into the daily lives of ordinary citizens, helping Ethiopia transition from an agrarian society to a modern, diversified economy.

Role in Foreign Direct Investment

Role in foreign direct investment (FDI) is where Al Amoudi shines as a unique figure. As one of Africa’s most prominent and trusted investors, he has attracted hundreds of millions of dollars from abroad into Ethiopia. His personal credibility and connections have encouraged other international businesses to consider Ethiopia as a safe and promising destination for investment.

Through projects like Saudi Star and partnerships with technology and engineering firms, Al Amoudi has brought in cutting-edge expertise, machinery, and financial capital. This not only strengthens the local economy but also bolsters Ethiopia’s image on the global investment map. FDI supported by Al Amoudi enables technology transfer, creates jobs, and supports the government’s efforts to transform the country into a middle-income economy.

Enhancing Regional and Global Trade

Enhancing regional and global trade is a key legacy of Al Amoudi’s vast business empire. His investments have turned Ethiopia into a stronger exporter of gold, grains, coffee, and horticultural products. For example, gold from MIDROC mines and rice from Saudi Star reach customers and buyers across the world, earning valuable foreign exchange.

Additionally, Al Amoudi has helped Ethiopia join regional and international value chains by creating modern logistics, storage, and processing facilities. This widens access to global markets for Ethiopian farmers and manufacturers, making their products more competitive. With stronger trade links, Ethiopia can diversify its economy, reduce its trade deficit, and increase its influence in Africa and beyond.

In summary, Sheikh Mohammed Al Amoudi’s broad and deep investments have a truly transformational economic impact on Ethiopia, from creating jobs and building infrastructure to strengthening international trade and economic stability.

Philanthropy and Social Responsibility

Healthcare Initiatives

Al Amoudi’s philanthropy in healthcare has had a real, lasting effect in Ethiopia and the region. Healthcare initiatives funded by him target the improvement of medical access for everyone, especially in rural and underserved communities. He has financed the construction of modern hospitals and clinics, providing state-of-the-art equipment that helps treat thousands of patients every year.

Hospitals, Clinics, and Cancer Research Centers

Hospitals and clinics built and managed through Al Amoudi’s charitable arms offer affordable or even free care to many Ethiopians. His investment is seen in specialized units focusing on maternal health, child health, and infectious diseases. Most notably, he has supported the creation of cancer research centers—a critical move in a country where cancer care was once hardly accessible. Al Amoudi’s funding helps with both infrastructure and the training of local doctors, bringing world-class expertise into Ethiopia and raising the standard of care for all.

Educational Investments

Al Amoudi knows that education is the key to a country’s future. His educational investments reach from primary schools to the university level, giving thousands of children and young adults a chance to improve their lives. The focus is on science, technology, and skilled trades, areas essential for Ethiopia’s growth.

Schools, Vocational Training, and Scholarships

New schools funded by Al Amoudi are equipped with modern learning materials and attract top teachers. He also backs vocational training centers that teach young people skills needed for jobs in today’s economy, such as construction, engineering, and health services. Besides building institutions, Al Amoudi provides a large number of scholarships for deserving students, especially those from low-income families. Many of these scholarships enable students to study abroad and bring valuable knowledge back to Ethiopia.

Community Development Projects

Al Amoudi’s community development projects aim to uplift entire regions, not just individuals. His investments provide safe drinking water through well drilling and water purification systems. Housing projects offer reliable and affordable homes to many families in need. He also funds sanitation and waste management improvements, leading to cleaner, healthier communities. These projects create jobs, support local businesses, and always consider sustainability for the long term.

Support for Sports and Local Causes

Sports play an important part in Ethiopian society, promoting health, unity, and national pride. Support for sports from Al Amoudi includes funding for local football teams, developing athletic facilities, and organizing community tournaments. Many promising young athletes have received sponsorships to compete at national and international levels. In addition to sports, he has provided critical backing to various local causes, like disaster relief, orphanages, and women’s empowerment initiatives. This broad approach to philanthropy helps Ethiopia build a brighter, more inclusive future for all.

Landmark Contributions

Pledge to the Grand Ethiopian Renaissance Dam

Pledge to the Grand Ethiopian Renaissance Dam stands out as one of the most significant contributions by notable Ethiopian billionaires like Sheikh Mohammed Al Amoudi. The dam is a national symbol and a key part of Ethiopia’s future, as it promises to transform the energy sector by providing electricity not only for Ethiopians but also for neighboring countries. Al Amoudi pledged billions of birr to support the dam’s construction, making him one of the largest private contributors. This financial support has helped accelerate construction and reassured the public and international stakeholders about the dam’s viability. Such contributions are seen as both patriotic and visionary, directly supporting Ethiopia’s ambition of becoming a regional power exporter.

Support for National Projects and Disaster Relief

Support for national projects and disaster relief has always been a priority for Al Amoudi. During major national crises, such as droughts or health emergencies, he has donated large sums to help affected populations. His support includes funding for emergency relief supplies, food distribution, water trucking, and rebuilding damaged infrastructure. On top of that, Al Amoudi has invested in development projects that uplift communities, such as constructing schools, healthcare centers, and water wells in rural areas. These efforts go beyond business interests; they underscore a deep commitment to Ethiopia’s stability and well-being. Whether the need is long-term development or urgent disaster recovery, his contributions have made a real difference in the lives of millions.

Environmental and Sustainable Practices

Environmental and sustainable practices play an important role in Al Amoudi’s business philosophy. With investments in agriculture, mining, and industry, there is always a risk of environmental harm, but Al Amoudi’s companies implement policies that focus on sustainability. For example, in large-scale farming like at Saudi Star Agricultural Development, water-efficient irrigation and eco-friendly farming techniques are used to minimize environmental impact. In gold mining operations, there are investments in modern processing facilities and land rehabilitation initiatives to restore mined areas. Efforts are also made to reduce emissions and manage waste in the petroleum and construction sectors. These practices show a responsible approach to business growth, balancing profit with the preservation of natural resources for future generations. This commitment to the environment enhances Al Amoudi’s legacy, not just as an investor, but as a steward of Ethiopia’s land and community well-being.

Leadership, Challenges, and Resilience

Detention and Release in Saudi Arabia

Detention and release in Saudi Arabia marked a turning point in Sheikh Mohammed Hussein Al Amoudi’s life. In late 2017, Al Amoudi was detained during a major anti-corruption crackdown. This shocked both local and global business communities because Al Amoudi was a pioneer among African and Middle Eastern billionaires. News and updates about his health and legal situation were tightly controlled, causing great concern in Ethiopia and beyond.

During his time in detention, much of his business empire faced uncertainty. Employees, partners, and relatives were worried about the possible collapse of his companies. Yet, Al Amoudi demonstrated remarkable resilience, even as rumors swirled about the reasons for his detention. After more than a year, he was released in early 2019, returning quietly to oversee his many projects. His release brought relief and inspired hope among his followers and partners.

Changes in MIDROC Leadership and Operations

Changes in MIDROC leadership and operations followed soon after Al Amoudi’s detention. MIDROC, his flagship company, had to adapt quickly, with senior managers stepping up to sustain business continuity. During these uncertain times, MIDROC’s board introduced new protocols to maintain stability, including delegation of key decisions and strengthening communications.

After Al Amoudi’s release, he focused on revitalizing MIDROC’s leadership team. He appointed trusted and experienced individuals to key positions and ensured robust checks and balances across the enterprise. Furthermore, MIDROC updated its corporate policies, placing more emphasis on risk management and transparency. These changes helped MIDROC regain strength, enabling the company to rebuild trust with partners and communities.

Response to Local and International Challenges

Response to local and international challenges has always been a defining feature of Al Amoudi’s leadership style. Facing turbulence in Ethiopia, where some of his operations dealt with social and political pressures, Al Amoudi’s firms focused on dialogue with local communities and authorities. When international market trends or oil price changes threatened his global assets, Al Amoudi’s teams acted swiftly, reallocating investments and seeking new business partnerships.

Amid the global COVID-19 pandemic, his companies put the safety of employees first, adapting workplace policies and supporting community health efforts. Al Amoudi’s adaptive strategies protected jobs and maintained business growth, even in turbulent markets. His ability to navigate both local obstacles and global crises has made him a respected figure in African and Middle Eastern business communities.

Defamation Cases and Legal Victories

Defamation cases and legal victories have further highlighted Al Amoudi’s resilience. Over the years, as a high-profile billionaire, he has faced several false accusations and damaging rumors, especially online. Al Amoudi responded by taking legal action in multiple countries to defend his reputation and the interests of his companies.

One notable victory was his successful defamation lawsuit in the UK, which set an important legal precedent for protecting public figures against fake news and slander. These legal battles did not distract him from his business and philanthropic missions, but instead, they strengthened his public image and reinforced the importance of justice. Al Amoudi’s persistent defense against misinformation has shown both determination and integrity, underlining his leadership in the face of adversity.

Recognition and Awards

Global Rankings and Honors

Global rankings and honors are a major part of understanding how influential Mohammed Hussein Al Amoudi has become on the world stage. For many years, he has been ranked among the richest people in the world by respected publications like Forbes and Bloomberg. Often, he has appeared on annual lists of billionaires as Africa’s richest or Ethiopia’s wealthiest man. His net worth has fluctuated due to the share values of his companies, oil prices, and business expansions, but he has consistently been placed in the top ranks in Africa and the Middle East.

Mohammed Al Amoudi’s business success and wealth have brought him international recognition beyond just financial figures. Awards and features in economic magazines have highlighted his achievements in oil, construction, agriculture, and mining. Being recognized on these global platforms shows not just his wealth but his influence in multiple industries. These honors have helped draw positive attention to Ethiopian entrepreneurship, putting the country on the map for global investors.

Academic and Government Recognitions

Academic and government recognitions show another side of Al Amoudi’s impact. Universities and research institutes in Ethiopia and abroad have honored him for his contributions to economic growth and philanthropy. He has received honorary degrees for supporting education, funding scholarships, and establishing modern schools in Ethiopia. These recognitions underline his role in helping the next generation excel.

Various governments have awarded Al Amoudi for his investments and positive impacts. The Ethiopian government has acknowledged him repeatedly for job creation, exporting gold, and developing modern industries. During major national events, he has been honored as a model investor and national contributor. Saudi Arabia has also given him official recognition as a business leader who strengthens ties between the two countries.

Overall, his academic and government awards are not just for business success but also for social responsibility and building lasting bridges between Ethiopia, Saudi Arabia, and the wider world. These honors continue to inspire others to follow his example in business, generosity, and national pride.

Lasting Legacy and Influence

Impact on Ethiopia’s Image and Investors

Impact on Ethiopia’s image and investors has been greatly shaped by Mohammed Al Amoudi’s achievements. For decades, his wide-ranging investments and public philanthropy have made headlines around the world. Many global business leaders and investors now see Ethiopia as a land of opportunity because of the successes of Al Amoudi’s companies in construction, agriculture, mining, and hospitality. His ability to bring massive capital and advanced business practices to Ethiopia has boosted the country’s credibility and attractiveness on the international stage.

Because of Al Amoudi, more international investors now feel confident doing business in Ethiopia. He is often credited for demonstrating that robust profits are possible, even in developing markets, when local industry meets world-class expertise. By putting Ethiopia on the map as a business-friendly destination, he has dramatically influenced the country’s reputation and growth.

Inspiring the Next Generation

Inspiring the next generation is one of Al Amoudi’s greatest legacies. Young Ethiopians and Africans frequently look up to him as a symbol of hope and what can be achieved through hard work, vision, and loyalty to one’s roots. His journey from humble beginnings to becoming one of Africa’s richest men shows that it is possible to reach great heights regardless of background.

The success of his vast business empire motivates young entrepreneurs to dream big and to take bold steps in industries like agriculture, mining, and finance. Many students and early professionals also benefit from his educational investments, including scholarships and vocational training programs.

Al Amoudi’s story shows that investing at home and supporting community development can leave a powerful mark. Through his leadership and actions, he encourages young people to combine ambition with a strong sense of social responsibility.

Vision for the Future of Ethiopia and Africa

Vision for the future of Ethiopia and Africa is central to Al Amoudi’s philosophy. He often speaks about building a continent that is not only rich in resources but also in opportunity for all its people. His investments in modern infrastructure, energy projects, healthcare, and education reflect his hope for a self-sustaining and prosperous Africa.

Al Amoudi’s efforts support technological innovation, food security, and greater access to global markets. He believes that Africa’s future lies in cooperation, modernization, and empowering local communities. Securing the foundations for lasting development, he urges others to look beyond short-term profits and to focus on projects that lift whole societies.

By supporting the Grand Ethiopian Renaissance Dam and many national projects, Al Amoudi sets an example for building a brighter African future. He dreams of an Ethiopia that is a leader not just in business, but in creating opportunity and peace for generations to come.