By Zehabesha Business Desk | October 2025

The Ethiopian Birr (ETB) continues its downward spiral, emerging as one of the weakest currencies in Africa. Since January 2025, the Birr has lost more than 30% of its value against the U.S. dollar, reflecting deep-seated economic fragility, galloping inflation, and persistent political turmoil.

According to data from both local and regional currency trackers, the exchange rate now exceeds ETB 145 per USD on the parallel market — a stark contrast to the official rate hovering near ETB 95. This growing disparity underscores a widening trust gap between the Ethiopian economy’s official management and real market realities.

A Currency in Crisis

Economists attribute the Birr’s collapse to a combination of structural and political factors. Ethiopia’s foreign currency reserves are at critically low levels, exacerbated by import restrictions, declining export revenues, and mounting external debt obligations.

“The Birr’s weakness is a symptom of deeper macroeconomic instability,” said one Addis Ababa-based economist who spoke to Zehabesha on condition of anonymity. “Without a credible fiscal framework and political stability, monetary policy tools alone cannot stop the depreciation.”

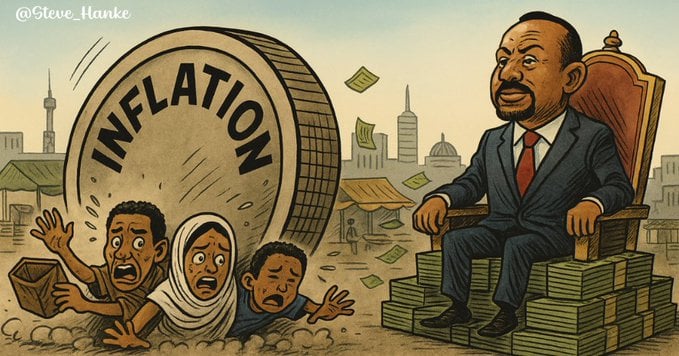

Galloping Inflation and Cost-of-Living Shock

The country’s annual inflation rate remains above 30%, eroding household purchasing power and pushing millions closer to poverty. Prices of food, fuel, and essential goods continue to surge.

A liter of cooking oil now costs nearly ETB 250, while basic food items like teff and wheat have more than doubled in price since 2023.

Urban workers and small business owners say the crisis has made everyday life unbearable. “We earn in Birr but think in dollars,” said a shopkeeper in Addis Ababa. “The prices change every week — it’s impossible to plan.”

Political Uncertainty Compounds the Decline

Beyond economics, political instability continues to weigh heavily on the Birr. Ongoing conflict in the Amhara and Oromia regions, the standoff between federal forces and local resistance groups such as Fano, and strained diplomatic relations with donors have discouraged foreign investment and aid flows.

With international partners increasingly wary of Ethiopia’s governance trajectory, the flow of foreign currency — crucial for imports, manufacturing, and debt servicing — has nearly dried up.

Desperate Policy Measures

In response, the National Bank of Ethiopia (NBE) has introduced a series of emergency measures, including tighter import controls, new forex licensing rules, and increased scrutiny of remittance channels. However, analysts warn that these short-term steps are not enough.

“Ethiopia faces a textbook balance-of-payments crisis,” said an economist from the Horn Economic Forum. “Unless there’s a comprehensive reform — restoring investor confidence, stabilizing politics, and liberalizing the currency — the Birr will continue to fall.”

A Call for Economic and Political Recalibration

The worsening exchange rate crisis has far-reaching implications: rising debt-servicing costs, a shrinking industrial base, and growing public frustration. Many now question whether the government can avert a full-blown financial meltdown without meaningful reform.

For a country once hailed as one of Africa’s fastest-growing economies, Ethiopia’s current economic trajectory is a cautionary tale of how unchecked inflation, governance failures, and political violence can cripple a nation’s currency and its people’s confidence.