July 10, 2025

The Habesha

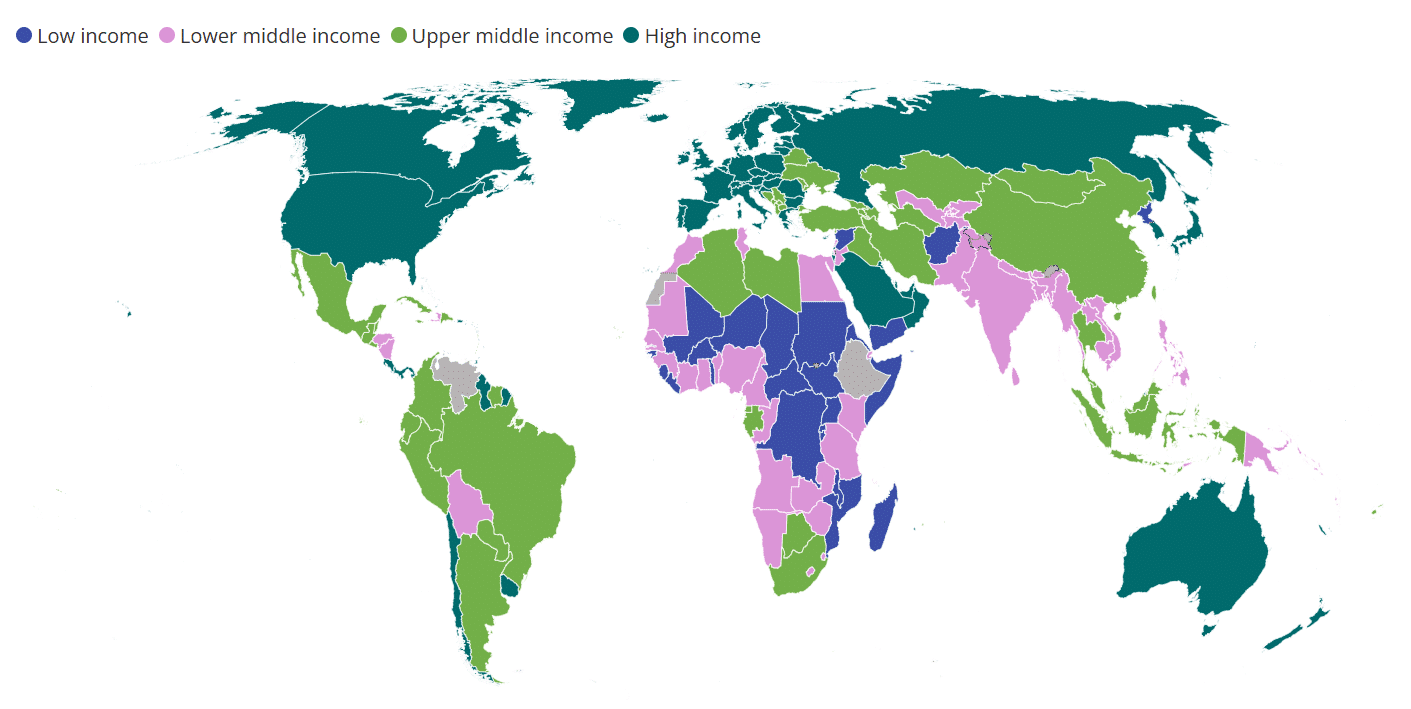

World Bank Income Classification for FY ’26

Ethiopia’s “unclassified” tag from the World Bank isn’t just a simple oversight—it’s like being handed a report card with no grades. Economists are puzzled as Ethiopia continues to receive billions in loans despite its murky data and wavering credibility. It seems like the World Bank is betting on a country that’s struggling to stand on its feet. Will transparency take a backseat in this game of geopolitical chess?

NEW: @WorldBank Group’s 2025-2026 country income classifications

Find out which countries have changed income categories this year and dive into the data behind the changes.

➡️ Read: https://t.co/3q06pukeEf #DataBlog pic.twitter.com/1jVpLmTSnv

— World Bank Africa (@WorldBankAfrica) July 12, 2025

With a massive $3.5 billion IMF deal and a $1 billion World Bank disbursement, you’d think Ethiopia would provide solid data. Instead, its financial institutions reel under political pressure, churning out more propaganda than genuine numbers. It’s bewildering how, amidst the disarray, Ethiopia’s leadership manages to launch ambitious projects while debt skyrockets. As the situation unfolds, one can’t help but wonder, “How long before the cards come tumbling down?”

Introduction to Ethiopia’s World Bank Classification Issue

Ethiopia’s classification by the World Bank has stirred tremors in the international community. The shift to an “unclassified” status is more than a mere technicality; it is a diplomatic slap that underscores the murky data surrounding Ethiopia’s economic and fiscal management. While economists shake their heads in disappointment, billions in international loans continue to pour in, hoping for stability in a nation perched precariously on the edge of economic survival. The looming question is: will transparency crumble under the weight of deceptive numbers?

Overview of Ethiopia’s Economic Classification

The Significance of the ‘Unclassified’ Tag

The ‘unclassified’ tag issued by the World Bank marks a critical and unprecedented status for Ethiopia. It is a public statement of distrust in the reliability of the nation’s fiscal data. Such a tag has profound implications, capturing the international spotlight and signaling to foreign investors and global policymakers that Ethiopia’s economic transparency and fiscal accountability are severely compromised.

This classification acts as a verdict on failed governance, reflecting the inability of Ethiopia’s financial institutions to produce credible economic reports. The Central Bank and the Finance Ministry, instead of providing reliable numbers, have been reduced to instruments of propaganda, promulgating talking points rather than factual data. This crisis of confidence extends beyond mere numbers; it mirrors a systemic collapse in governance and institutional integrity.

Impact of This Classification on Ethiopia’s International Standing

Ethiopia’s international standing is gravely impacted by this label. The “unclassified” status acts as a deterrent for foreign investment and strains the nation’s diplomatic relations, effectively placing Ethiopia on a global watchlist. It paints a picture of a state deeply mired in misinformation, thus affecting its capacity to engage in fair economic dealings and international financial markets.

Foreign institutions now face a dilemma: continue investing in a country with a lack of financial credibility, or retract their support, risking the destabilization of Ethiopia’s already shaky economy. Despite the constraints, international bodies like the IMF and World Bank have been generous with their fiscal aid, a move that raises questions about their reasoning in propping up a regime lacking fiscal transparency and legitimacy.

Historical Context of Ethiopia’s Economic Situation

Recent Economic Reforms Promised by the Government

Ethiopia’s government has not been silent in the face of this crisis. Promises of economic reforms have been a common chant from the governance corridors. These reforms were marketed as a signal of the government’s commitment to turning around the nation’s economic fortunes, with grand visions of modern infrastructure, industrialization, and market liberalization.

However, these pledges have largely fallen short. The anticipated $3.5 billion IMF deal and the $1 billion World Bank disbursement were structured to fuel these reforms, but Ethiopia’s persistent struggle to produce credible income data has thwarted genuine progress. The grand reform narratives now increasingly resemble mere smoke and mirrors, aimed more at appeasing international onlookers than at effecting substantial changes on the ground.

Challenges Faced by Ethiopian Institutions

The challenges facing Ethiopia’s institutions are multifaceted and deeply entrenched. Politicized staffing has crippled key financial entities like the Central Bank and the Finance Ministry, converting them from independent bodies into mouthpieces for governmental propaganda.

Furthermore, internal disarray and institutional collapse are visible in the continuing inability to provide transparent and accountable financial reports. These challenges demonstrate a broader systemic failure, where governance is hampered by both internal corruption and external pressures. The current economic predicament reflects these underlying weaknesses, necessitating comprehensive structural overhauls to prevent further deterioration.

Ethiopia’s economic trajectory is perilous, with its institutions embroiled in a cycle of political manipulation and inefficiency, demanding urgent and tangible reforms to regain both domestic stability and international credibility.

Ethiopia’s Current Economic Conditions

Ethiopia’s economic landscape is currently marked by turbulence and uncertainty. As the nation navigates through these challenging times, various aspects of its fiscal and monetary strategies are under intense scrutiny. International loans and support that were once envisioned as a lifeline have turned into a complex web of dependencies.

Monetary and Fiscal Policies Under Scrutiny

Role of the Central Bank and Finance Ministry

The Central Bank of Ethiopia, alongside the Finance Ministry, is at the crux of the nation’s economic policy-making. However, both institutions are facing immense criticism. Their credibility has significantly declined due to allegations of politicization and inefficiency. The Central Bank, traditionally responsible for maintaining monetary stability, is currently struggling with issues like inflation and currency devaluation. These problems are compounded by the Finance Ministry’s difficulties in securing credible fiscal policies that can stimulate economic growth while appeasing international expectations.

Both institutions have seemingly transformed into instruments of political agendas rather than the pillars of economic governance. Their reports, once factual and data-driven, have morphed into narratives fueled by political motives.

Integrity of Financial Data and Reporting

Integrity in financial data reporting is crucial for any country’s economic planning and international cooperation. Unfortunately, Ethiopia has seen a significant decline in the trustworthiness of its financial data. Reports suggest that the presented data often misrepresents the actual economic conditions to fit a narrative that supports ongoing government policies. This lack of transparency not only affects domestic economic planning but also diminishes the confidence of international bodies and investors.

Ethiopia’s financial data is perceived as murky, raising questions about the nation’s ability to meet international economic standards. This skepticism undermines the nation’s reputation, making it difficult to garner the trust needed for broader economic engagement and aid.

Impact of International Loans and Support

IMF Deals and World Bank Disbursements

International support through IMF deals and World Bank disbursements has been a double-edged sword for Ethiopia. While these funds are essential for addressing immediate economic needs and maintaining fiscal stability, they also bind the country to certain expectations and reforms. The recent $3.5 billion deal with the IMF and $1 billion from the World Bank exemplify this delicate balance between support and dependency.

These loans have raised questions about the efficacy of such financial aid, especially in a context where financial governance is under question. Rather than spearheading solid economic reforms, the funds often plug temporary leaks in a struggling economy.

Criticism from Global Economists

Global economists have consistently criticized the ongoing financial aid Ethiopia receives, arguing it lacks accountability and doesn’t adequately demand concrete reforms. The funneling of billions into a fiscally unstable environment comes across as an endorsement rather than a corrective measure.

Critics argue that unconditional financial support perpetuates a cycle of dependency and authoritarian governance, overshadowing the vital issue of human rights and political freedom. As international scrutiny intensifies, many suggest a reevaluation of how aid is administered and its real impact on the country’s long-term political and economic trajectory.

Without a commitment to genuine transparency and accountability, Ethiopia risks remaining in a vicious cycle of financial inefficiency and political instability, where external funding merely acts as a band-aid rather than a solution.

Government Spending and Military Expenditures

The Ethiopian government has continued to funnel enormous resources into projects and military investments that invite controversy and international criticism. This emphasis on spending reflects an administration focused on fortifying its power base rather than addressing the fundamental needs of its citizens.

Controversial Projects and Military Investments

Construction of High-Cost Infrastructure

The construction of high-cost infrastructure projects, such as the much-debated $15 billion palace in Addis Ababa, represents an enormous financial drain. This lavish development is perceived by many as an embodiment of misplaced priorities, especially at a time when Ethiopia faces heightened economic challenges. Critics argue that such extravagant expenditures do not align with the pressing needs for basic infrastructure that would tackle poverty and enhance public welfare.

Moreover, these projects often proceed without transparency or accountability. Large sums are allocated with little scrutiny, leaving many wondering about both the source and the sustainability of these funds. They cast a shadow over the intentions of the government, raising doubts about whether such initiatives truly serve the Ethiopian populace or merely bolster the ruling elite.

Acquisition of Military Assets

Equally contentious is the acquisition of military assets. In recent years, Ethiopia has significantly increased its spending on military hardware, purchasing drones, tanks, and aircraft from countries like Turkey, Iran, and China. This arms buildup, paired with increasing mobilization efforts, amplifies tensions in already volatile regions including Amhara, Tigray, Oromia, and Gambella.

Such investments reflect a preoccupation with military might over humanitarian imperatives. They raise troubling questions about the government’s commitment to peace and economic development. Is this investment spurred by genuine security needs, or does it serve as a tool for internal control and suppression of dissent?

Domestic and International Repercussions

Security Measures and State Surveillance

On the domestic front, security measures and state surveillance have seen significant escalation. The government has poured millions into technologies that track and monitor its citizens, employing sophisticated surveillance techniques as part of an effort to reinforce state security. While touted as necessary for national security, these measures have come under fire for infringing on personal freedoms and civil liberties.

The aggressive expansion of state surveillance creates a climate of fear and suspicion among the populace. It erodes trust in institutions and stifles free expression, elements crucial to democratic development and stability.

Effects on Internal Conflict and Stability

The impact on internal conflict and stability is profound. The surge in military expenditure has not translated into peace or nation-building but instead, has intensified hostilities. Regional fragmentation and ethnic militarization are on the rise, leading to a cycle of violence that the government appears more intent on escalating rather than resolving.

This approach to governance poses significant risks to Ethiopia’s future stability. As conflict zones expand, resources are stretched thinner, undermining both civilian safety and economic prospects. With international observers watching closely, the government’s emphasis on militarization only serves to deepen Ethiopia’s isolation and compound its challenges on the world stage.

The heavy focus on government spending for controversial projects and military assets not only drains valuable resources but also risks further destabilizing an already fragile state. The questions of accountability, priority, and intent loom ominously, demanding a reevaluation of Ethiopia’s trajectory in both national and international contexts.

Global Community’s Perception and Reactions

The global community has been keeping a close watch on Ethiopia’s governance and its complex socioeconomic landscape. There is a wide range of responses, particularly from Western institutions and international human rights bodies, highlighting diverse perspectives on the country’s future direction.

International Response to Ethiopia’s Governance

Western Institutions’ Continued Financial Support

Western Institutions continue to maintain a flow of financial support to Ethiopia, despite clouds of criticism swirling around its governance. The World Bank and the IMF have funneled billions of dollars towards Ethiopia, implicit in their actions is a belief—or a hope—that Ethiopia is too big to fail. This financial intervention, however, raises questions about the intentions behind continued support when blatant governance issues persist.

- Why do these institutions persist in providing support despite Ethiopia’s inability to provide credible financial and economic data?

- How do they rationalize supporting a government embroiled in civil conflict and accused of severe human rights violations?

Their assumption seems to be that with enough fiscal assistance, Ethiopia might transition toward stability and reform. Yet, the ground realities reflect a bleak picture.

Human Rights Concerns and Ethical Considerations

Alongside financial engagements, Western countries and humanitarian organizations have voiced concerns over human rights abuses in Ethiopia. The conflict across regions like Amhara, Tigray, Oromia, and Gambella has drawn international condemnation, but direct actions have been sparse.

- Allegations of human rights violations include indiscriminate attacks, mass displacements, and ethnic persecution.

- Humanitarian advocates are calling for stronger sanctions and more stringent compliance measures regarding financial aid.

The ethical dilemma arises from balancing the immediate humanitarian needs of the Ethiopian populace against the actions of a government that uses foreign funds in ways that may perpetrate strife, enhance surveillance, and bolster military campaigns. This dichotomy is ever-present in policy discussions across Western capitals.

Evaluation of Ethiopia’s Future Trajectory

Potential for Reform and Recovery

Looking forward, there remains a possibility for reform and economic recovery in Ethiopia, although skepticism prevails. Potential signs of reform could revolve around:

- Establishing transparent and accountable governance structures.

- Ensuring ethnic and regional inclusivity in political proceedings.

- Revamping economic policies that cater to the wider benefits of its citizenry.

However, realizing these potential reforms requires a commitment to a genuine democratization process.

Risks of Further Economic and Political Degradation

The current trajectory of Ethiopia suggests numerous risks which could exacerbate both its economic and political conditions, such as:

- A further plunge into debt, exacerbating economic instability.

- Intensified conflict caused by ethnic tensions, potentially leading to more fragmentation.

- Continued devaluation of the national currency, eroding public confidence.

Without a drastic strategic shift in governance, Ethiopia might face spiraling social and economic chaos. The need for urgent international diplomatic engagements and multilateral dialogue is critical to forge a path forward that supports the Ethiopian populace while holding their leadership accountable.

The world watches closely, poised at a proverbial crossroads, waiting to see which path Ethiopia will traverse.

Conclusion: The Path Forward for Ethiopia

Necessary Steps for National Stability and Transparency

Ethiopia’s path to national stability and transparency is steep and fraught with challenges, but certain steps could pave the way. Firstly, restoring credibility requires the government to genuinely commit to transparency in financial and governance systems. This means abandoning propaganda and revealing real economic data. Such openness would help rebuild trust with citizens and international partners alike.

Furthermore, addressing institutional breakdown is critical. The central bank and finance ministry must operate independently, free from political manipulation. Their role in producing accurate and honest data cannot be overstated. Engaging qualified professionals devoid of political ties will restore credibility to financial oversight.

A transparent probe into government spending, particularly on controversial military expenditures, should be a priority. Ethiopia needs a budget that prioritizes social investment over military supremacy. This redirection will ensure resources address development needs rather than inflate an already immense debt.

Finally, fostering inclusive governance is paramount. Acknowledging ethnic diversity and facilitating open dialogues among different groups will reduce tensions and encourage national unity. Embracing diversity as a strength rather than a challenge is fundamental for sustainable peace.

Role of International Partners and Financial Institutions

International partners and financial institutions play a vital role in Ethiopia’s journey toward recovery. They must shift from a strategy of blind financial support to a demand for accountability and reform. Ethiopia’s international supporters should press the government to adhere to international standards of transparency and human rights.

Financial institutions, including the World Bank and IMF, must align their disbursements with strict conditionalities that promote fiscal integrity. This will not only ensure money is used appropriately but will also encourage real economic reform. Loans and grants should be contingent on measurable improvements in governance and economic transparency.

Additionally, international actors can offer technical assistance to rebuild Ethiopia’s crumbling institutions. Supporting capacity-building programs within the central bank and finance ministry will underpin the restoration of financial credibility.

Lastly, a diplomatic approach encouraging peaceful conflict resolution should be adopted. International bodies can act as mediators, facilitating dialogue among Ethiopian factions to prevent further military intervention and, instead, promote a peaceful, unified nation.

In conclusion, the combination of internal reform and external guidance will be pivotal for Ethiopia’s resilience. By committing to these necessary steps, the nation can chart a course toward stability and prosperity, benefiting its citizens and reassuring the global community.