ዘ፡ሐበሻ

June 21, 2025

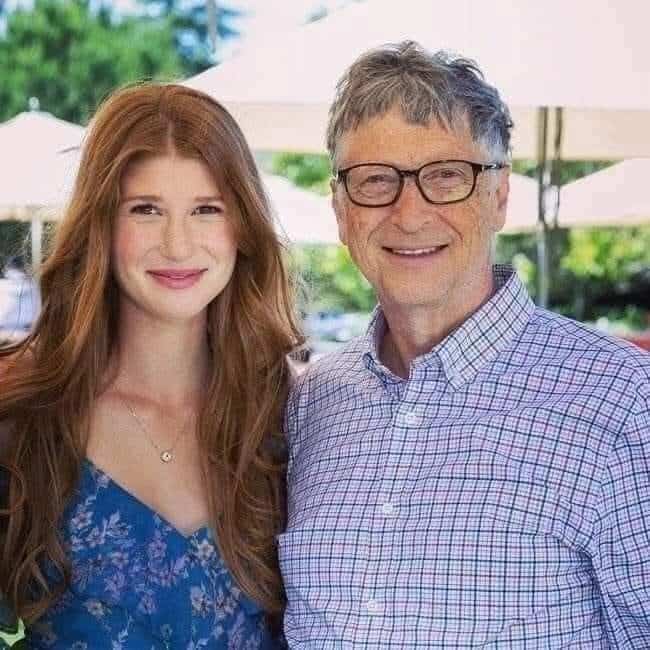

“My daughter will never marry a poor man!” was the headline that caught the attention of many when Bill Gates candidly shared his views on wealth and marriage. During a finance conference in the United States, an intriguing question was posed to Gates that made the audience chuckle: Would he let his daughter marry someone who isn’t financially well-off? His answer was simple yet profound, sparking curiosity about what it really means to be wealthy.

According to Gates, true wealth transcends a big bank balance—it’s about having the ability to create wealth. He explained that even lottery winners, flush with cash, could still possess a poor mindset, leading to financial failure within a few years. Gates emphasized the difference between rich and poor lies not in possessions but in mentality. Those who seek continuous learning and personal growth embody wealth, regardless of their current financial status.

Understanding Bill Gates’ Perspective on Wealth

Redefining Wealth Beyond Money

Wealth as the Ability to Create Wealth

Bill Gates believes that true wealth is not defined by the number of zeros in a bank account but by the ability to generate more wealth. This notion underscores the significance of having the skills and mindset to create value. Wealth, in Gates’ view, is not static. It is dynamic and requires a combination of knowledge, perseverance, and a vision for the future.

He explains that simply possessing money doesn’t equate to being wealthy. For instance, a lottery winner may come across millions overnight but lacks the foundational skills and financial intelligence to sustain that wealth, which leads us to the next point.

The Illusion of Sudden Wealth: Lottery Winners

The story of lottery winners often serves as a cautionary tale in Bill Gates’ narrative. Many who suddenly acquire large sums fail to hold onto their fortunes because they view money as an end rather than a means. According to Gates, around 90% of lottery winners eventually squander their winnings within a few years.

This phenomenon occurs because sudden wealth can be bewildering and overwhelming, especially for those unprepared to handle such financial responsibility. Gates emphasizes that understanding and managing money is integral to being wealthy, rather than just having a fleeting abundance of it.

Entrepreneurs: Wealthy Without Money

The Role of Financial Intelligence in Wealth

Bill Gates suggests that many entrepreneurs are examples of individuals who might not yet have significant financial resources but possess the mindset and tools to become truly wealthy. They illustrate how financial intelligence—the knowledge and capability to manage finances effectively—is crucial in the wealth creation journey.

Entrepreneurs often reinvest their earnings back into their businesses, demonstrating foresight and a belief in potential growth. They focus on honing their skills and leveraging opportunities, which is why Gates regards them as wealthy in the truest sense.

Distinguishing Between Bank Account and True Wealth

The distinction between merely having money and achieving true wealth revolves around a deeper understanding and relationship with money. Gates argues that true wealth involves creative vision, investing in one’s abilities, and continual personal development. It embodies an individual’s capacity to overcome challenges and adapt to changes in the economy or business landscape.

He points out that people who relentlessly seek to grow and improve are inherently wealthier than those who solely seek immediate financial gain. Such an approach ensures not just financial stability but also the fulfillment that accompanies personal success.

The Mentality Differences Between Rich and Poor

In the world of wealth and poverty, the mentality differences between rich and poor individuals play a crucial role. It isn’t just about the money in one’s bank account; it revolves around mindset, resourcefulness, and a continuous journey of self-improvement and understanding.

Mindset and Resourcefulness

A mindset full of resourcefulness and a willingness to adapt is a common trait amongst wealthy individuals. It is marked by a constant drive to seek knowledge, improve oneself, and adapt to changing situations to achieve financial prosperity.

The Drive to Learn and Improve

The drive to learn and improve is a cornerstone of a wealthy mindset. Rich individuals don’t stop learning after formal education. They’re always on the lookout for new skills. They engage in reading, attend workshops, and listen to wisdom from other successful people. This habit of lifelong learning prepares them to seize new opportunities and handle adversities efficiently.

Short Note: Learning isn’t about formal education; it’s about maintaining curiosity and valuing growth.

Understanding Blame vs. Personal Growth

Another vital element is how individuals approach blame and personal growth. Wealthy minds consistently focus on self-improvement. They reflect on their failures and draw lessons to grow both personally and financially. In contrast, blaming external factors such as the government, corporations, or the economy is often a mindset associated with poverty. This not only halts progress but also fosters resentment and resistance to change.

Important: Personal growth requires owning up to one’s mistakes without indulging in blame games.

Misconceptions About Wealth

Misconceptions about wealth often dictate how individuals from different economic backgrounds perceive and pursue financial success. These misconceptions shape the overall attitude toward wealth accumulation and personal development.

Rich People’s Belief in Training and Information

Rich individuals have a profound belief in training and information. They understand that with the correct training and the right information, advancement is inevitable. Continuous education and seeking valuable information empower them to innovate and make informed decisions, paving the way to amass wealth.

“The rich invest in time; the poor invest in money.” – Warren Buffett

Poor People’s Dependence on Others for Wealth

Conversely, there is a tendency among those with a poverty mindset to depend on others for financial upliftment. This dependency is fueled by the misconception that one’s financial fate is solely determined by external forces like inheritance or luck. Thus, depending on others for wealth instead of taking personal initiative may often lead to missed opportunities for independence and self-sufficiency.

Note: True wealth blooms from self-reliance and not dependence on external financial aids.

Understanding these mental barriers is vital for fostering a healthy and productive relationship with wealth. It’s about shifting perspectives from what is lacking to cultivating what can lead to financial freedom.

Applying Bill Gates’ Wealth Philosophy to Marriage

The intriguing perspective of Bill Gates on wealth extends beyond merely the accumulation of money. It significantly impacts his views on the institution of marriage, especially concerning the person who might marry his daughter.

Criteria for Marrying His Daughter

Bill Gates does not equate a healthy bank account with the ability to provide a thriving life. Rather, the ability to cultivate wealth is a key criterion. Here, wealth is viewed as a dynamic process involving creativity, intelligence, and perseverance. A potential suitor is expected to exhibit these qualities, proving his capacity for generating wealth, growth, and stability.

Ability to Cultivate Wealth

This ability transcends traditional financial acumen or socioeconomic status. It means being proactive, seeking out opportunities, adopting innovative ideas, and adapting to changing circumstances. Gates believes that this entrepreneurial mindset embodies true wealth. The significance lies in demonstrating a proactive approach towards gravitating from potential to actual financial success through dedication and ingenuity.

Avoidance of a Poor Mindset

Equally important is steering clear of a poor mindset, which can impede personal and financial growth. A poor mindset is characterized by a tendency to assume a victim’s stance, assigning blame to external factors without seeking self-improvement. Bill Gates believes that cultivating a mindset of learning, resilience, and gratitude is crucial. A suitor should embrace challenges and constantly strive for growth, reflecting a wealthy state of mind even when devoid of material riches.

Security and Integrity as True Richness

Beyond material assets, Gates emphasizes the values of security and integrity as embodiments of genuine wealth.

Lessons from the Bank Security Guard Story

The anecdote about the bank security guard choosing integrity over immediate financial gain serves as a vivid illustration. The guard’s decision to return a bag full of money, recognizing the long-term value of honesty, ultimately paved the way for substantial professional growth. This story underlines how integrity can serve as a foundation for true richness, valued both in personal and professional realms.

Long-Term Gains Over Short-Term Money

The narrative further emphasizes opting for long-term benefits over short-term gains, a conviction firmly held by Gates. It’s about understanding that short-term temptations don’t equate to success. Instead, true wealth lies in seeing the broader picture, prioritizing principles, and investing in long-term growth and stability. Gates envisions a life partner for his daughter who shares this value system—someone who understands that true richness entails both nurturing enduring relationships and adhering to ethical standards, rather than merely accumulating short-term profits.

By intertwining these values with wealth creation, Gates communicates a profound message: that the pursuit of genuine wealth should mirror a commitment to principled living, respect, and integrity, all integral to a harmonious and prosperous marital life.

Conclusion: Wealth as a State of Mind

Understanding that wealth is fundamentally a state of mind can transform one’s perspective on money and success. It is not just about the zeros in a bank account, but rather about possessing the mindset and skills to generate, manage, and sustain wealth over a lifetime. This philosophy emphasizes that anyone, regardless of their current financial status, can embark on the journey to wealth by cultivating the right mindset.

Financial success hinges on the ability to adapt and learn, and the willingness to see opportunities where others see nothing. It means continuously investing in one’s education and skills, leading to self-improvement and prosperity. True wealth lies in being resourceful and having the attitude that embraces growth, innovation, and resilience against setbacks.

Equally important is overcoming the societal misconceptions that equate temporary financial windfalls with true richness. Wealth as a state of mind teaches us that integrity, perseverance, and the ability to build wealth from the ground up are core principles of genuine prosperity.

As Bill Gates implied, marrying someone who embodies this state of mind ensures that his daughter aligns with a partner capable of sustaining a prosperous life, through both thick and thin. It’s this viewpoint that redefines what it truly means to be rich: not constrained by the present monetary value, but liberated by the unyielding ability to generate future wealth and make thoughtful decisions.

Ultimately, this mindset is not only about financial stability but also about securing happiness, fulfillment, and a life that reflects true richness beyond fiscal measures. Let us aim to cultivate this mindset, recognizing that wealth starts from within.

The concept originates from Financial Coaching With Krizzia.