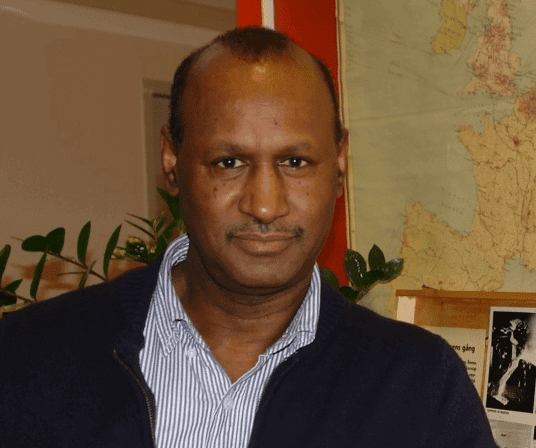

Tanya L. Cole, Senior Commercial Officer, commercial service at the US embassy in EthiopiaWhile the economic footprint from Africa and particularly Ethiopia may seem to be dominated by Chinese and to a lesser extent Turkish and Indian investments, largely out of view the economic presence from the world’s largest economy, the US which also happens to house the largest number of the Ethiopian Diaspora as well as the country’s well known innovative business approach.

newBusinessEthiopia.com’s Elias Gebreselassie in interviewed Tanya L. Cole, Senior Commercial Officer, commercial service at the US embassy in Ethiopia and discussed a range of issues ranging from the embassy’s efforts in attracting investments back to Ethiopia, the progress in investments seen from particularly US investors of Ethiopian origin and how’s the US’s well known creativity and innovation could be of help to Ethiopia’s fledgling economy.

nBE: How’s the economic section of the US embassy helping in attracting investments especially equity investments to Ethiopia?

Cole: With the recent opening of the new Department of Commerce Foreign Commercial Service Office at the U.S. Embassy Addis Ababa, we have created a valuable resource where U.S. companies can learn about doing business in Ethiopia, including tax incentives for Government of Ethiopia priority driven investment sectors.

We can help companies align their investment and trade strategies to complement that of the Government of Ethiopia and put them in contact with the relevant and appropriate decision-makers and key Ethiopian business partners.

We work with our economic colleagues in the State Department to provide U.S. companies with critical insight on Ethiopian business and investment policy and regulation.

Furthermore, we work with the local Ethiopian and Addis Ababa Chamber of Commerce to attract sustainable U.S. investors and responsible trade through multi-sector trade missions from the U.S. For example, we recently hosted the Commerce Trade Winds multi-sector trade delegation of 10 companies from the aviation, consumer products, ICT- mobile applications, and management sectors.

We also do capacity building workshops on creating more transparent and value-added life cycle procurement tender, evaluation and award procedures.

Using our B2B international trade shows, we take delegations to key trade shows in the energy, healthcare, construction, and tourism sectors to build capacity and attract investors. We also use these trade promotion events to brand Ethiopia as a top trade and investment destination with untapped potential in the energy, textile, and other infrastructure sectors.

We have a global team of trade specialists located in key cities across the U.S. that serve as a counseling resource for Diaspora and U.S. companies interested in doing business in Ethiopia.

We also support trade shows in textile, agricultural, construction, energy, ICT, tourism and hospitality, and lead Ethiopian delegations to these shows to learn about new technologies, meet buyers and investors.

According to the Africa Infrastructure Country Diagnostic, Africa’s infrastructure spending needs stand at about $93 billion per year. African governments spend about $45 billion a year on infrastructure, $15 billion of which is contributed by donors and the private sector.

Ethiopia is expanding and improving its infrastructure as evident in Addis with all of the construction and this also creates space for private sector growth and SMEs innovation and expansion in the service industry especially conference planning, management, logistics, hospitality and those services associated with the opening and launching of new infrastructure.

The US government recognizes the need to expand the renewable energy power sector to fuel this growth and through Power Africa: USAID and other key agencies have embarked on a program to help not only Ethiopia, but sub-Saharan Africa rapidly increase its megawatts across the continent.

USAID is providing transaction advisory services for the Corbetti Geothermal project to establish the first independent power purchasing agreement in Ethiopia, which can pay the way for other renewable energy on and off-grid projects.

nBE: What would you say has been the progress you’ve seen in terms of investments from Ethiopian origin investors and non-Ethiopian origin investors willingness to invest in size and scope?

Cole: I have seen positive growth through more investment in large scale renewable energy, textile and agriculture processing projects.

I expect this will grow with the re-extension of the African Growth and Opportunity Act (AGOA) for another 10 years.

I have also seen high quality projects in the tourism sector from leading Ethiopian construction and real estate companies to build new hotels like the recent Marriot Apartments and the planned Hilton Luxury Resort in Hawassa, in addition to state-of-the art high rise condominium and mix-use buildings.

These projects cost in the millions of dollars and demonstrate a shift from smaller projects to an expansion in infrastructure and private sector investment. I would expect this trend to continue with the expansion of trade routes from Ethiopian Airlines and their quality Boeing Airline Fleet and state-of the-art training academy.

They are recognized as the best in class African aviation company and have received global awards for their quality service.

This will attract more investors to Ethiopia—having a reliable and quality airline with global connections.

nBE: US is known as land of innovation and creativity. What mechanisms are you putting in place so that the investments have a high human knowledge component, novelty and creativity?

Cole: We have “Doing Business in Ethiopia” webinars that include presenters from American companies who are already on the ground to help new companies navigate market entry and adapt their products to the current GTP2 which has a focus on job creation, technology transfer, private sector development, and opportunities for local sourcing and manufacturing.

We also are able to tap into our Commerce global teams to “leap frog” new technologies to Ethiopia like electrical vehicles, smart city transportation mobile applications and digital health applications for rural support.

We would like to launch a clean tech innovation center here in Ethiopia with public private partnership support that facilitates rapid technology transfer and sustainable financing in the clean energy space. Our reverse trade missions – taking private sector Ethiopian companies and Ethiopian officials to key U.S. cities to see these centers and technologies creates a dynamic platform for innovation.

nBE: Could you tell me in facts and figures how particularly equity investments from the US, and how they’ve fared, and the coordination you do with local authorities and business people to make the investments successful?

Cole: I can’t provide facts and figures for equity investors as this information is confidential and could affect their funds and investments.

We try to cut down the time from project interest to actual investment by putting them in touch with the right decision-makers who can help facilitate their projects. We like to compete on quality and try to educate the decision-makers on the what we can provide them and that “cheap can be expensive” in the long run especially for critical infrastructure projects.

nBE: What do you see as the opportunities and challenges when a US firm invests or plans to invest in Ethiopia?

Cole: We have all the usual challenges that other countries face: foreign exchange to get the goods and services for a project, navigating customs, closed banking, and transportation logistics, and the bureaucracy of getting timely licenses and approvals to launch the project and bring in the appropriate equipment.

As always, time is money and the lag-time from project initiation, approval, to financing and implementation can negatively affect the calculated rate of return on the investment. Taking into consideration the positives of a population of close to 100 million, low labor and energy costs, and the rapid infrastructure development, there is certainty unlimited opportunity for investment.

The challenge remains how to best manage the financial risks of project delays and obtaining critical resources required to successfully launch a project. Having a reliable and transparent process for investments and trade can attract the right types of investors to the market and not those only looking at profit margins.

nBE: What should we expect in the near to medium future with regards to investments especially equity investments in Ethiopia?

Cole: If Ethiopia can improve its investment climate and ease of doing business, then we will be able to expect a significant growth of investors to the market in the key sectors of textile, energy, and agro-processing.

The low labor costs and low energy costs are attractive to investors trying to control manufacturing costs. With added capacity, training and improved technology, Ethiopia has unlimited opportunities.

Just as the Ethiopian Investment Commission is working on a one-stop investment center, we are also working on registering an American Chamber of Commerce to serve as a one-stop trade and investment resource for U.S. companies.

This will help facilitate fast-tracking of investment projects by serving as a first-stop resource for the Ethiopian government to assist U.S. companies seeking information and contacts on doing business in Ethiopia.

The U.S. Foreign Commercial Service is in partnership with the Ethiopian government to attract sustainable trade and investment and encourages responsible development through technology transfer.