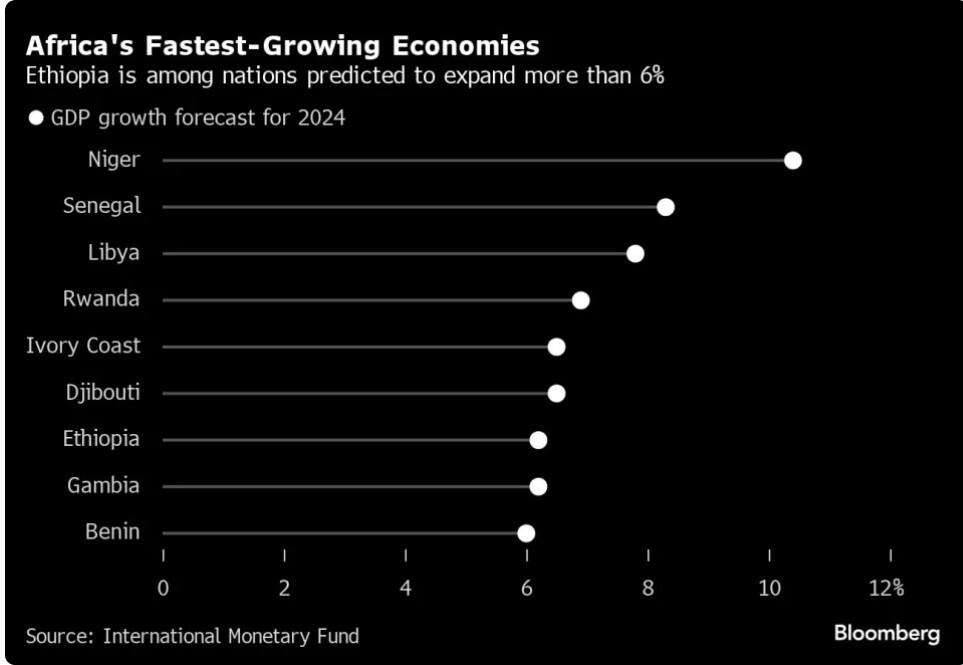

The National Bank of Ethiopia recently declared the restructuring of the nation’s foreign exchange management system in response to the Ethiopian government’s macroeconomic reform program. This immediate reform is designed to shift Ethiopia towards a more competitive and market-oriented foreign exchange system, tackling persistent macroeconomic instability and distortions.

The National Bank of Ethiopia recently declared the restructuring of the nation’s foreign exchange management system in response to the Ethiopian government’s macroeconomic reform program. This immediate reform is designed to shift Ethiopia towards a more competitive and market-oriented foreign exchange system, tackling persistent macroeconomic instability and distortions.

The reform’s execution will adhere to the updated foreign exchange directive and is a component of the wider domestic economic reform agenda and forthcoming macroeconomic adjustments.

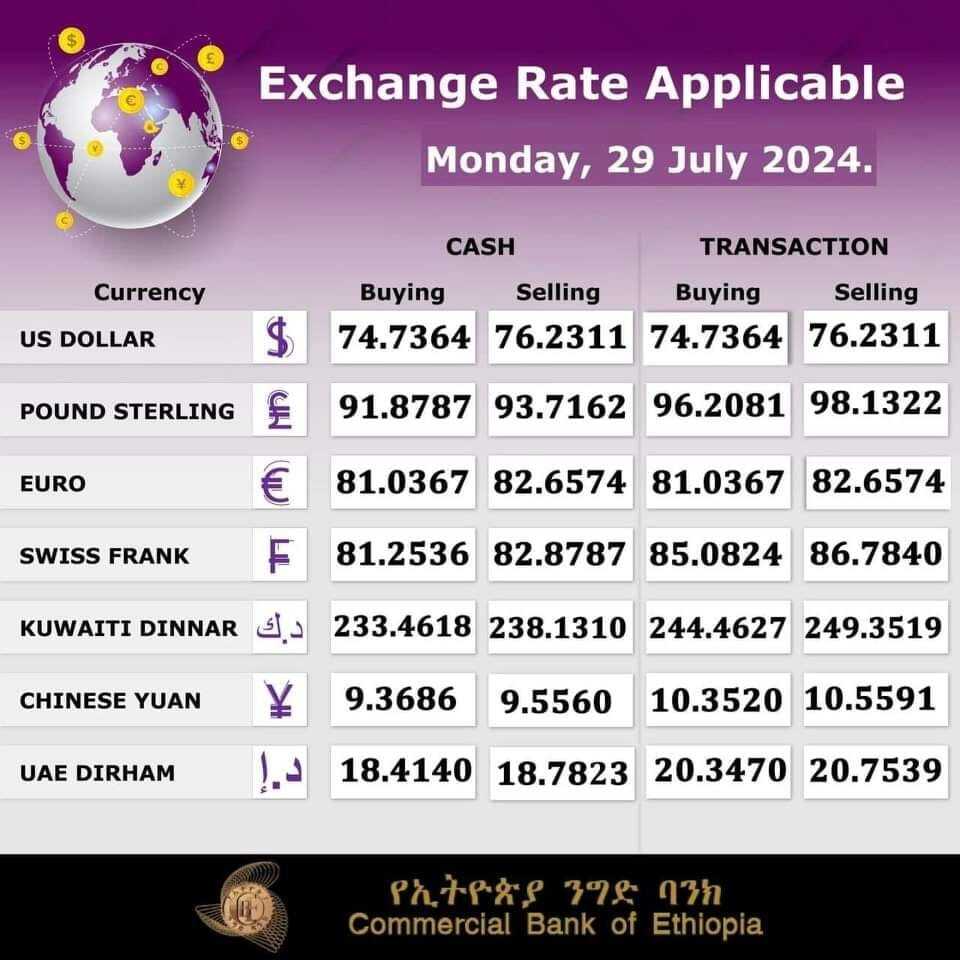

The recent foreign exchange management reform, effective immediately, will bring about significant alterations. The approach will shift towards a market-based system, where exchange rates will be determined by banks and their clients. The National Bank of Ethiopia will have a crucial role in stabilizing the market.

Exporters and commercial banks are no longer obligated to transfer foreign currency to the National Bank of Ethiopia. This modification will enable them to retain their foreign exchange earnings, resulting in an increase in foreign currency availability for the private sector. The ban on 38 imported goods has been lifted, while restrictions on capital account outflows remain intact.

Exporters will now have the opportunity to retain a larger portion of their foreign exchange earnings, as the previous requirement of keeping 40% to 50% has been removed. The regulations concerning foreign exchange transactions for incoming goods at banks will remain the same. Furthermore, private non-bank foreign exchange bureaus will be established alongside existing bank-operated bureaus, allowing them to engage in buying and selling foreign currency at market rates.

A new regulation is scheduled for release to remove restrictions on importing goods in franc currency. Various laws regarding foreign currency accounts for foreign entities, investors, and Ethiopians abroad have been implemented.

Ethiopian residents can open foreign currency accounts for remittances, salaries, and other earnings, using them for foreign payments. The interest rate cap on foreign loans by private companies or banks has been lifted.

Foreign investors can now participate in the Ethiopian Securities Exchange, while companies in special economic zones have special privileges for foreign currency transactions, such as retaining all foreign earnings. Restrictions on the amount of foreign currency travelers can carry in and out of Ethiopia have been lifted.

The government’s financial aid is aimed at low-income government employees and those reliant on social welfare programs. The primary goal of the policy is to shield no more than 10% of the population from the financial downturn. However, the substantial subsidy requires additional funding from the national budget.

The approach to covering the subsidy is still being deliberated. Options include securing loans, seeking help from wealthy individuals, or even resorting to printing more money. However, these methods are contentious and lack support from international financial institutions.

The policy overlooks the impact of conflict on the economy, as well as issues of corruption, lack of justice, and governance. The proposed administrative remedy is viewed as a short-term solution, despite the challenges posed by the imbalance between the supply and demand of foreign currency. The effectiveness of the subsidy as a solution for the vulnerable is also being called into question.

A lack of growth in disposable income is likely to result in a slowdown in both the market and the economy, hindering any potential revival. By increasing the income of the sizable regular paying community, which consists of over 4 million individuals, demand, production, and supply can all see a boost. The question arises as to why attention is not being received in this regard.

TH

If I am an exporter, why would I exporter anything,… we all know that exporters are made at huge loss,… why would I incurred a loss and give away my 50% USD to the banks and buy it again at higher price,.. that will be a “double” loss. Therefore, instead of exporting, I would rather bargain any buy the USD from local Banks… please think of it from finance perspective… double loss vs single cost.

July 30, 2024 at 11:28 pm

If I am an exporter, why would I exporter anything,… we all know that exporters are made at huge loss,… why would I incurred a loss and give away my 50% USD to the banks and buy it again at higher price,.. that will be a “double” loss. Therefore, instead of exporting, I would rather bargain any buy the USD from local Banks… please think of it from finance perspective… double loss vs single cost.

Reply

If I am an exporter, why would I exporter anything,… we all know that exporters are made at huge loss,… why would I incurred a loss and give away my 50% USD to the banks and buy it again at higher price,.. that will be a “double” loss. Therefore, instead of exporting, I would rather bargain any buy the USD from local Banks… please think of it from finance perspective… double loss vs single cost.

Reply