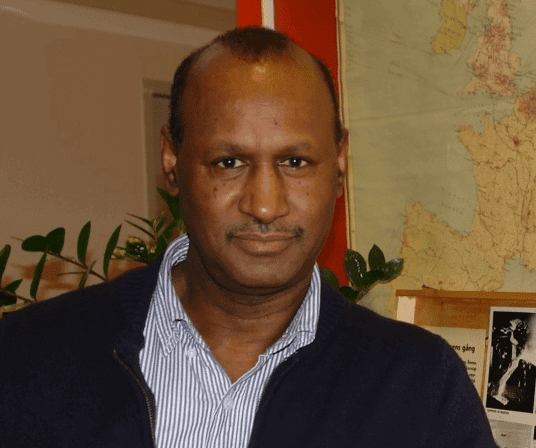

Ethiopian Finance Minister

The decision to open up the banking sector to foreign investors will help to attract Foreign Direct Investment (FDI), advance financial inclusion, and create service competitiveness, Finance Minister Ahmed Shide said.

The Council of Ministers has recently passed a landmark decision to open the Ethiopian banking sector to foreign investors.

In an exclusive interview with ENA, the finance minister said the National Bank of Ethiopia is working on the details of the regulatory aspect, which will be submitted to the Council of Ministers, and then to the parliament in the coming few months.

Opening of the banking sector for foreign direct investment (FDI) is part of the Homegrown Economic Reform program that has been implemented, he added.

“Once operational, it (the policy) will attract significant investment into the country in terms of additional finance and will expand the banking sector in general. It will also introduce competition in the banking sector, further boosting the financial inclusion agenda of the government and modernizing the banking sector.”

According to him, Ethiopia is striving to improve the investment climate and attract private sector investment and this historic decision will boost the competitiveness of the financial sector by unlocking the potential of the financial market.

On top of improving macroeconomic imbalance, the decision will help to create efficient, technologically equipped, and competitive banking industry that triggers critical chain effects on all economic activities.

“So, significant investment will be facilitated as a result of this, and by introducing additional capacity, competition, modern technology, and new financial services, (it) will further boost the financial sector in general, advance our financial inclusion agenda and enable more our business sector,” the minister elaborated.

Domestic banking sector has been enjoying a lot in the past in terms of growing, Ahmed stated, adding that “their growth will be enhanced as a result of this competition. They need to consolidate, upgrade, and be ready for the competition.”

Over the last four years, total asset of the local banks has soared from 1.3 trillion Birr to 2.4 trillion Birr, registering 92 percent growth; while total deposit increased from 899,811 billion Birr to 1.7 trillion Birr.

The number of banks has increased from 18 to 30 with the total capital of banks jumping from 98.9 billion Birr in 2019 to 199.1 billion in 2022, registering 27 percent average yearly growth.

ENA

The only thing it really accomplishes in a an unpeaceful and turbulent nation with skyrocketing inflation is hand-over all national assets as well as citizen’s holdings and properties for dirt cheap prices.

This buy-out invitation for Foreign banks at this most inopportune moment (from the Ethiopian perspective) would surely go down as the most treasonous in Ethiopian history (worse than even the loss of Eritrea and the Red Sea facilitated by Meles Zenawi and co.)