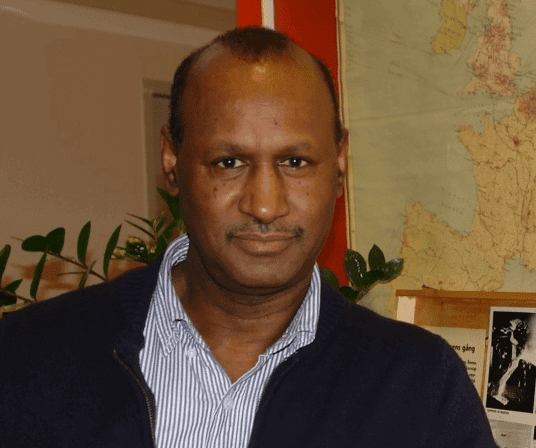

Ethiopia’s deputy prime minister, Hailemariam Desalegn, dismissed forecasts that economic growth would slow sharply this year and next and that monetary policy was pushing up inflation, saying growth may exceed 10 percent.

Expansion won’t drop below 9 percent in the fiscal year to July 7, 2012, from 11.4 percent this year, Hailemariam, who is also the minister of foreign affairs, said in an interview at the Ethiopian Embassy in London yesterday. International Monetary Fund data show the economy has expanded an average of 11 percent over the past seven years.

The IMF forecast on May 31 that growth may slow to 6 percent next year from 7.5 percent in the current fiscal year, citing faster inflation and restrictions on bank lending. This year’s pickup in inflation is due to higher global food and fuel costs and not loose monetary policy, Hailemariam said.

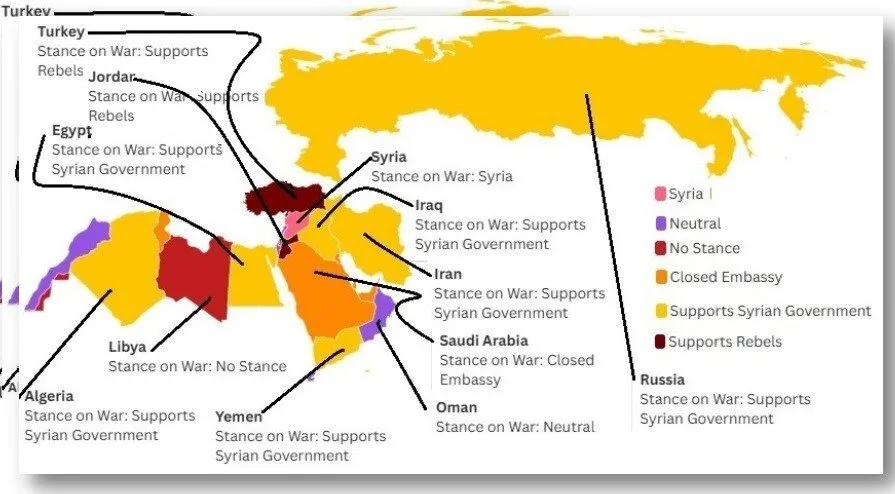

Price increases “in Ethiopia are imported inflation, it’s not domestic-driven inflation,” said Hailemariam. “Oil has soared because of the Middle East problem and if that problem is sorted somehow then immediately the price will do down. So it’s a temporary problem that’s pushing inflation in Ethiopia.”

The inflation rate jumped to 29.5 percent in April from 25 percent a month earlier as food prices increased, the Central Statistical Agency said on May 10. Broad money-supply growth was 35 percent at the end of March, said the IMF, which had previously projected growth of 22 percent in money supply this fiscal year.

Savings and Sustainability

Ethiopia has stepped up savings through the sale of bonds to individuals, said Hailemariam, after a World Bank official said higher inflation may undermine savings and leave the country reliant on foreign capital to finance investment projects.

“The whole community has mobilized to buy bonds,” he said. “This huge savings and mobilization is used for infrastructure development.”

Ethiopia plans to borrow at least 398.4 billion birr ($23.5 billion) from home and abroad to fund a five-year growth plan, with an additional 75.4 billion birr to finance fiscal deficits over the same period.

The investment plans are unsustainable without a jump in domestic savings, Ken Ohashi, the World Bank’s country director for the Horn of Africa nation, said in a June 7 interview. Plans to lift the savings rate to 15 percent of gross domestic product by July 2015 from 5 percent will be hindered if inflation continues to accelerate, Ohashi said.

“We are getting loans from China, India, Turkey and South Korea, so all these foreign savings are also mobilized,” Hailemariam said. “So I think we can perform on the ambitious plans that are in place.”

Foreign Banks

Ethiopia operates a mixed economy that encourages foreign investment while state enterprises dominate or monopolize key industries such as telecommunications, banking and power generation.

The government may liberalize its banking industry in the “mid-term” though it will take time because of weak central bank regulations, few foreign reserves and the need to establish domestic lenders before introducing international banks, Hailemariam said.

“We might complete these reforms in five or ten years but it’s a mid-term, it cannot be a long-term process,” he said. “There is a huge gap between imports and exports and that balance of payment is creating lots of problems at this moment and we have to work hard to generate more exports.”

To contact the reporter on this story: Chris Kay in London at ckay5@bloomberg.net.

To contact the editor responsible for this story: Gavin Serkin at gserkin@bloomberg.net.