Dr. Suleiman Walhad

May 27th, 2022

Banks in the Horn of Africa States, as was the case in most other jurisdictions or parts of the world, had physical presence in the markets they operated in and had traditionally a domestic banking license. They were marked by a large number of employees, face-to-face encounters with their customer and had dedicated account managers. Banking penetration was low and only the government administrations and high-income groups were the main customers of these banks. But the world is changing, and the banking industry is also changing as all other human activities, with the presence now of sophisticated communication processes, enabled by worldwide internet services, and so the banking and financial services in the Horn of Africa States had to change and it is changing and reforming, albeit with several drawbacks. However, banking in the region remains intriguing and exiting as it was always, for the art of monies stashed away in vaults in banks, still remains as mysterious as it was, in the past.

The banking and finance sector unlike other regions of Africa has grown and expanded faster in terms of numbers than other regions in Africa, over the past two decades, in the main, because the region was behind in earlier eras to develop this industry, as the systems of rule and governance in place in the region for most of the past fifty to sixty years, was based on command economies of the socialist era of the seventies and eighties of the last century. It was also one of the fastest growing and profitable economic enterprises in the region, as the banking system was innovating and expanding beyond the traditional account holding and trade financing outlets, they were in the past. Banks now finance real estate and provide mobile banking services, in addition to the traditional account holding services and trade finance activities. The new processes are helping deepen banking penetration in the society, limiting heavy use of cash, though consumer credit services, remains rudimentary. There are no credit bureaus in the region and usage of ATMs remain limited at best. Money transfer business and paying one’s bills and obligations through mobile networks have expanded and the smartphones of today were helpful in this regard. This is attracting people of the region to the banking industry and its services, which again helps banks contact larger numbers of potential customers.

Yet the profitability of financial institutions and/or revenue growth continue to be derived from the geographic footprint of the banks and other financial institution, i.e., their physical presence. Banks and financial services still provide services to the higher income and middle-income groups of the region and the largest segment, the lower income groups and SMEs remain underserved and hence contribute less to the profitability and revenues of the banking and finance institutions of the region. It is those latter groups that would eventually contribute to most of the profits and revenues of banks and finance institutions in the future for they are the largest and fastest growing groups of the populations. Current and future technologies would enable them draw into new financial services.

The banking industry was seen as an industry for the big boys and ladies in the past and this is changing through this new innovative mobile services. There were, indeed, many opportunities missed by the banking industry in providing services to the largest group of the population, which did not have access to the banks and therefore did not have current and savings accounts, no borrowing or any other financial services and it is all changing through the fast money transfer services and mobile banking that have been introduced. Collaboration between banking and telecommunication institutions to deliver financial services at a cost below that of maintaining a physical branch network was helpful in these processes.

Though mobile banking and digital processing is making financial services more accessible, faster, and better, yet the banking and finance industry in the Horn of Africa remains far short of the services it could provide as a full-service industry. Some of the needs of the region cannot be met solely by the government or by one bank or one institution. They need to learn the art of collaborating with each other to provide finance for larger projects. This is generally in banking parlance referred to as lending/loan syndications, where a group of banks can put together finance for a project of one customer be it a government or a corporate, with each bank contributing a portion of the finance required according to its risk appetite. A syndication is generally managed by a chosen party or the party initiating the product with the customer.

The financing of the Grand Ethiopian Renaissance Dam (GERD) through a bond issue was close to a syndicate although this was organized by the government and financed by the general public. It generally is the same process where one party “A” in need of funds for, say, building a new textile factory, requests a bank to arrange a syndicate to finance the project. The funds are, generally, too large for one bank and therefore, the Party “A” asks bank “B” to arrange a syndication of banks to finance the large amount/borrowing, required by the project. Bank “B” generally reaches a general contract with borrower “A” on the terms and conditions of the finance, in terms of pricing, structure, duration of the finance and payment arrangements, the collaterals and/or guarantees and so on. Once the general outline of the terms and conditions, is finalized, bank “B” starts to present the project and the financing infrastructure agreed upon with borrower “A” to other banks. Several banks may agree to participate in the financing of the project. Some may be ready to contribute US$ X million, while other may agree to assume US$ Y million, but others may agree to put in, say US$ XY million, and so on. Altogether ten banks may finally agree to provide the total funding required and so would the project be financed and completed as envisaged.

Lending syndications is one product that is yet to penetrate the Horn of Africa States’ banking and financial industry. And perhaps, it is why many would-be entrepreneurs do not venture into larger and more sophisticated projects that would have helped expand the economic pie of the region for they all work with their wits and smaller capacities. A number of sticks held together is stronger than one stick which can be easily snapped. It is on the same formula that working together instead of just competing with one another is one clever way of growing together, while each still maintains one’s customer base.

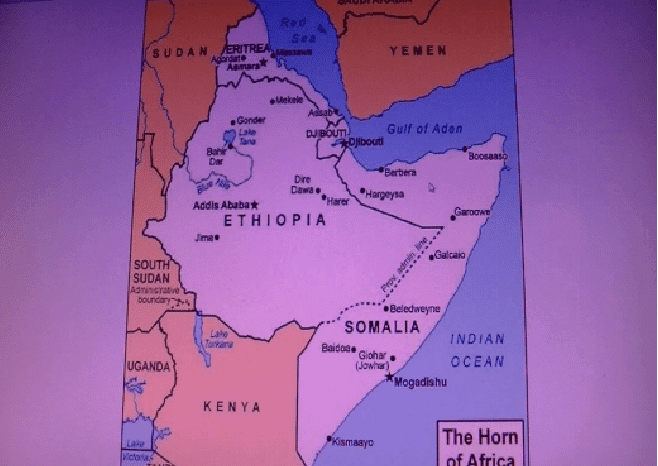

Banking penetration remains low in the region, and this offers the industry an opportune space to exploit, not only for its business but also helping lift up many more from the low income brackets they seem to be locked in, to an expanded economically viable segment. The Horn of Africa States banking industry is still nascent, although growing fast. However, the market is not small (some 157 million). There are still no foreign banks operating in the region, although the process of opening up is perhaps already underway. Collaborating with foreign banking parties would bring in new technologies and new products and services and perhaps more efficiencies along and it should always be encouraged. Members of the Horn of Africa States have different risk levels, but overall, they do present together a new frontier for winning business models suitable for the market.

In addition to introducing new products or maybe allowing foreign entrants into the market, the banking industry of the Horn of Africa States should also look into economies of scale and instead of a larger number of banks, the industry should look into merging as well. This would allow creating sizeable institutions that could compete with others. They would also need to expand into other regions of Africa, where they can perhaps also draw other benefits, noting that the Africa space offers one of the greatest prospects for banking growth and profits.

Many banks in Africa are now busy offering cross-border services or even opening up branches in other regions of the continent. We see Nigerian and South African banks operating in many other parts of Africa. It is perhaps time that banks in the Horn of Africa States region started to expand to other markets. The East Africa region offers many opportunities and so do all other regions of the continent. It is for the intrepid entrepreneurs that create wealth. “Those who are comfortable in only where they know cannot and would not grow”, so says a Somali proverb. Banks need to adopt to new ways of doing things and operating in new environments. Perhaps operating first in each others’ markets would enable banks of the region, venture into other more distant markets.

Another major product missing in the Horn of Africa States banking industry is the interbank money market. It generally refers to the modern-day financial system which involves banks trading cash and other instruments with other financial institutions and banks. It may also involve banks borrowing from one another when they are short of cash to finance a venture or a project. It does not involve non-financial institutions or consumers and investors. The interbank market does not have a central or single location or authority. It is spread across the world throughout the working week, with the general exception of a few internationally and unanimously accepted holidays such a New Year’s Day. Banks using the services of another bank is an art and an activity that is missing from the banking industry in the region, perhaps due to ignorance or even mistrust among the banks. Generally, spot transactions of interbank markets are settled two business days following a trade execution. This is a generally agreed upon convention. In order to lower risks, banks may have netting agreements between each other. This netting process reduces the amount of cash or money that would change hands as well as the default risks inherent in banks facing unexpected financial difficulties during the settlement period.

“Sticks in a bundle are unbreakable”

*Dr. Walhad writes on the Horn of Africa economies and politics. He can be reached at walhad@hornafric.org