ByRachel SavageandDawit Endeshaw|Reuters

Ethiopia is facing a critical decision regarding a potential significant devaluation of its currency in order to secure a rescue loan from the International Monetary Fund (IMF). Unfortunately, the recent visit by the IMF to the country concluded without reaching an agreement with the authorities, making the need for a decision even more urgent. This comes at a challenging time for Ethiopia, as it is already grappling with high inflation and became the third African nation to default on its debt in December. Since 2020, Ethiopia has not received any funds from the IMF, and its previous lending arrangement with the organization derailed in 2021. In late 2022, the federal government and a rebellious regional authority managed to sign a deal, bringing an end to a two-year civil war.

During its most recent visit, the IMF acknowledged the progress made but did not explicitly state that currency reform is a prerequisite for its support. However, it is worth noting that the IMF generally supports flexible exchange rates determined by the market. Last year, sources informed Reuters that Ethiopia had requested $3.5 billion in assistance from the IMF. The country’s persistent foreign currency shortages and strict control over the exchange rate have created an environment conducive to the growth of a black market. Currently, the birr is traded at a rate of approximately 117 to 120 per dollar on the black market, which is more than double the official rate of around 56.7.

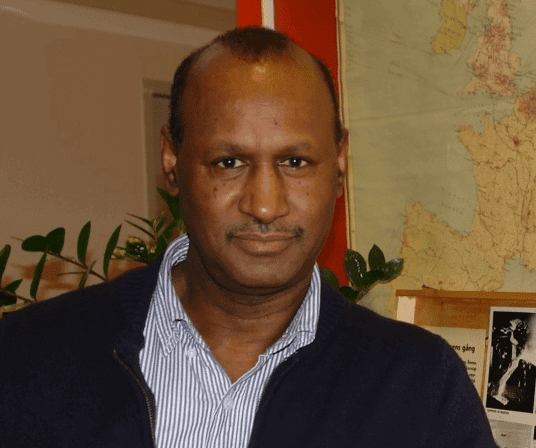

It appears that the Ethiopian government is facing challenges in meeting the requirements set by the IMF,” mentioned Abdulmenan Mohammed, a British-based economic analyst from Ethiopia. “The Ethiopian officials are concerned about the potential devaluation of the birr, which could lead to significant adverse economic consequences such as high inflation rates and an increase in foreign currency debts when converted into birr.”

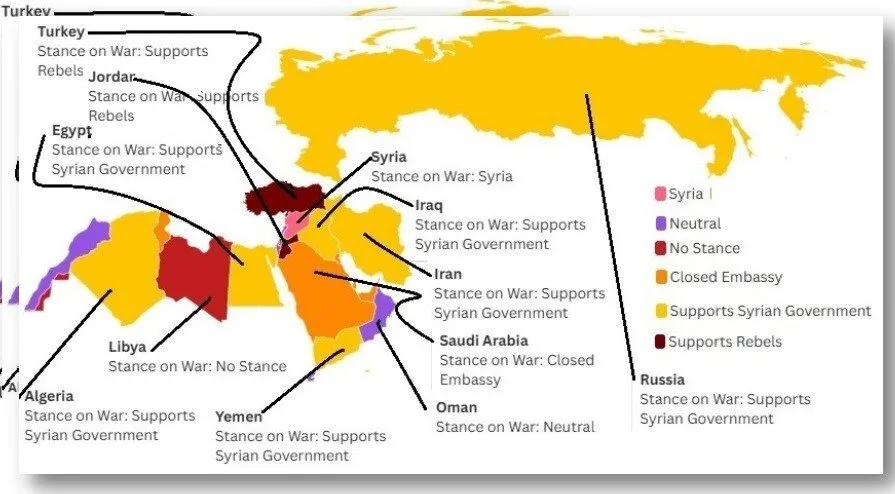

The civil war initially caused a delay in the progress of Ethiopia’s request for debt restructuring under the G20’s Common Framework, which was established in response to the COVID-19 pandemic to include newer creditor countries such as China and India.

The nation’s foreign debt stood at $28.2 billion as of the conclusion of March, as per official records.

By August 2023, a moratorium on debt payments was obtained from the primary bilateral lender, China, which had pledged $14 billion to the country from 2006 to 2022, as reported by Boston University’s Chinese Loans to Africa Database.

The rest of Ethiopia’s bilateral creditorsfollowed suitin December, but said they could cancel the relief if Ethiopia did not get an IMF deal by March 31. When the deadline lapsed, it was extendedto June 30.

By looking at other nations that disintegrated from IMF-devaluation induced economic collapse, I recommend that IMF wait a little bit more until things in Ethiopia become even more precarious to force the devaluation so the disintegration that the West seeks could be effected with the loudest bang and irreversibly. Life in Ethiopia right now is hell. Currency devaluation will clearly make it intolerable. With all the fuel from ethnic-based massacres, hate speech and freezing of economic activities due to the lack of peace and security, you drop this currency devaluation on top of it and Baaaaam! Still, I suggest that IMF and the gang wait a little bit more for a more perfect implosion.

Of course, I am being sarcastic.