The exchange rate is the price of a currency relative to another currency or a basket of currencies. Unlike the price of goods and services, the exchange rate is a unique and abstract relative price in a way that it represents the relative state and dynamism of the local economy within the pecking order of the global asset, trade, and financial systems. While the currencies, especially fiat money, do not have intrinsic value, they reflect the inherent purchasing power of the respective economies.

The exchange rate is the price of a currency relative to another currency or a basket of currencies. Unlike the price of goods and services, the exchange rate is a unique and abstract relative price in a way that it represents the relative state and dynamism of the local economy within the pecking order of the global asset, trade, and financial systems. While the currencies, especially fiat money, do not have intrinsic value, they reflect the inherent purchasing power of the respective economies.

The exchange of goods and services across countries, when mediated through foreign exchange, links tradeable domestic and international commodities, finance, and assets, thereby shaping the real exchange rate. From such a perspective, the choice of foreign exchange rate policy plays a prominent role in shaping the relative performance of national economies and their opportunities in the global market. It is therefore imperative that the exchange rate serve as an abstract barometer to measure the health of an economy relative to the rest of the world with which it exchanges and trades economic resources.

The global foreign exchange market is extremely large in size and liquidity depth, with daily transaction volume hovering around USD 7.5 trillion. This volume and growth of the forex market suggest that no national government, large or small, can influence the market alone, and the market players operate in a highly competitive and volatile setting. In such a setting, national governments pursue economic policies that position them for relatively effective use of such a liquid market to their advantage.

National economies pursue exchange rate policy regimes in one of three ways: the fixed exchange rate, the freely floating regime, or the hybrid managed floating regime. While foreign exchange market forces largely determine the exchange rate, most monetary authorities exercise some form of intervention and follow a cocktail of approaches to manage their exchange rate movement. The way such managed exchange rate regimes operate and signal information to the public are essential elements in the economic policymaking eco-system of countries.

The fixed exchange rate regime with pegged rates, which was most common among less developed economies, has become increasingly unsustainable in the context of a large and highly liquid global foreign exchange market system.

However, venturing into the freely floating exchange rate policy regime without solid domestic macroeconomic stability involves a prohibitively high risk of crisis in the face of an extremely large and dynamic global foreign exchange market. It is judicious for policymakers in developing countries with weak economic, institutional, and technical foundations to pursue a sequential and gradual approach towards establishing a solid domestic economic policy environment first before liberalizing their exchange rate policy regime.

The Ethiopian currency, the Birr, has shown continuous weakness against all currencies but especially against the US dollar. The monetary authorities have undertaken a series of devaluation measures over the past three decades to correct the misalignments. The official exchange rate of the Birr currently hovers around 55 birr per US dollar. The vibrant parallel market offers a premium that is 85 to 104 percent higher than what the official market pays.

While this represents a glaring gap between the official and parallel markets, the current political, economic, and security environment in the country and the worsening relative competitiveness of the economy suggest that the current notional fair value of the currency is even worse. An asset portfolio framework based on the nominal exchange rate suggests that the notional fair value exchange rate of the Birr is in the range of 162 to 174 Birr per US dollar.

This model considers not only the tradeable segments of output and finance but also the asset market decision choices of economic agents both within and outside the country. The financial and asset market opportunities in Ethiopia are still at a rudimentary stage and do not fully capture the asset allocation opportunities for Ethiopians and foreigners to build their portfolios. And yet, the notional implications of such market forces on the exchange rate valuation provide a contour of where the fair valuation of relative prices of assets stands and how to sequence any monetary policy reform.

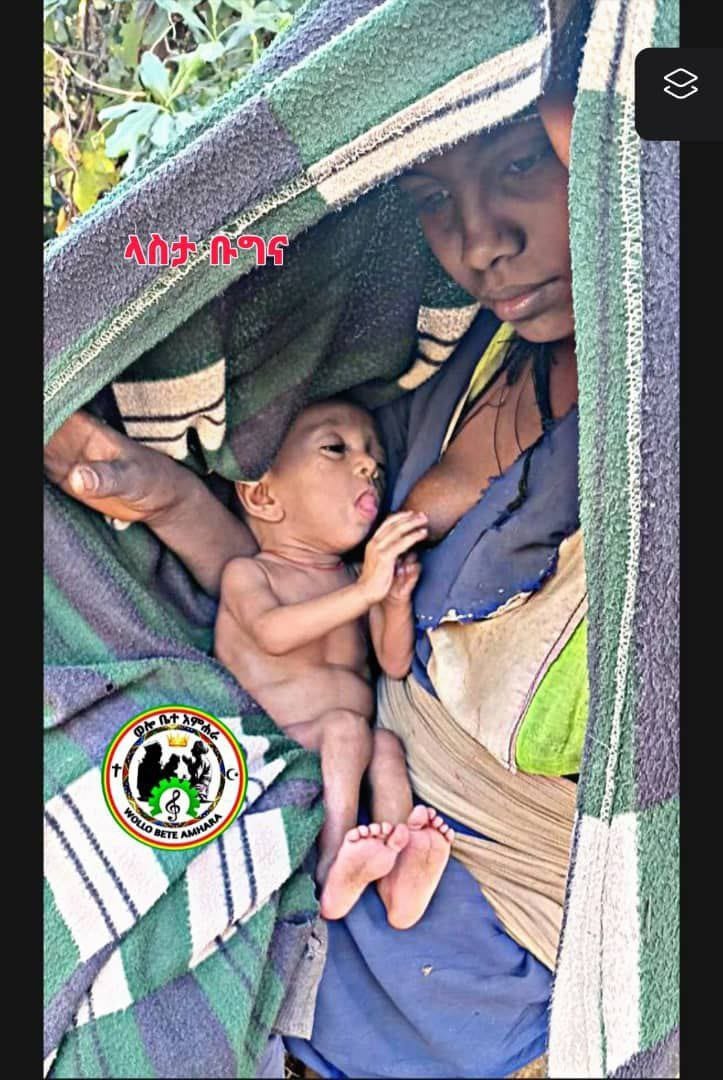

The Ethiopian economy is in its worst form, with rampant inflation, high unemployment, a suppressed financial system with a negative real interest rate, and a low and still depleting capital stock. Added to this is the overall deterioration of the security environment, which has piled up the risk for investment and production activities. These are major challenges that need immediate attention and emanate from domestic political, security, and economic distortions.

External factors might have played a marginal role, but priority must be given to domestic policy problems. Such a deep-rooted economic challenge requires putting in place a very pragmatic approach to monetary and exchange rate policy that prevents the momentum towards a full-scale crisis from becoming an unavoidable reality.

In such a situation, the Birr exchange rate ought to be indicative of the relative health of the Ethiopian economy as seen in the imports of goods, ideas, and services into the global market. This, in turn, requires efficient use of human and natural resources and setting up a continuous learning environment for all citizens to build up capabilities in the global network of the value chain.

The revealed and notional relative health of an economy is ultimately the most comprehensive way to determine the valuation of market participants regarding the relative value of the currency compared to other currencies.

The state and performance of the Ethiopian economy are such that whatever meager resources are at its disposal have not been used effectively or efficiently. The widespread misallocation and inefficiency, coupled with increasing corruption in almost every sphere of economic activity, have made the economy struggle to survive, let alone thrive. Unrealized potential, lost opportunities, and misallocation of its vital economic resources have trapped the economy in underperformance both relative to its potential and against its rivals in the global economy.

Ethiopia has about 56 million laborers and produces an estimated aggregate output of USD 112 billion as of 2021. This is extremely poor performance in all aspects and measurements. Its sectoral composition is such that the aggregate output has failed to fulfill the basic needs and necessities of life for a large segment of the Ethiopian population.

To put the size in relative context, a single and humble company, Toyota Motors, produces about USD 249 billion per year with a labor force of a mere 0.372 million workers worldwide. To add insult to injury, the country is engaged in an extremely destructive conflict that destroys an already depleted stock of capital and livelihood.

The country is adding about 2.16 million young people to the labor force, and the economy is barely able to keep up, let alone absorb the huge number of additional workers. Such a severe state of the economy calls for bold and pragmatic economic policy reform that unlocks the straightjacket imposed on the productive power of the country and allows the economy to operate near its full employment capacity.

Ethiopia should remove all the hurdles for its citizens to earn a decent living by engaging in productive activities, urgently train its labor force in different talent and skill areas that the economy requires, ensure access to energy, water, and capital for smallholder farmers and rural residents across the country, and build the policy and physical institutional infrastructure to enable productive use of economic resources.

The political mess has also fragmented an already weak national economic space, and citizens are increasingly forced to operate within their tribal enclaves, hence breaking down an integrated national economic system.

While the world is striving to take advantage of a rapidly globalizing economy, Ethiopians are busy breaking whatever weak national economic infrastructure they have managed to build over generations. Unless this is reversed and much more is done to rebuild an integrated national economic space in which all citizens and even foreigners are free to do business, create value, and create employment opportunities, the economy will remain in shambles, and the living standard is bound to get even worse.

Ethiopia generates foreign exchange from a set of sources with peculiar features. These include remittances, agricultural exports, a bit of industrial and service exports, foreign direct investment (FDI), and external loans and grants.

Remittance inflows from the Ethiopian diaspora community, which is about one million strong and contributes about USD five billion annually, have increasingly become an important source of hard currency for the country. About two-thirds of the remittance inflow comes from the US, Saudi Arabia, and Israel, mainly from young Ethiopians who opted to migrate abroad and still expected to provide financial assistance to their relatives and even friends back home.

The opportunity cost of such remittance inflows is increasing over time, both in terms of effort, risk of abuse, and even loss of life. There is no more repulsive behavior than implicitly robbing such migrants who happen to send their hard-earned money back home. An artificially overvalued exchange rate serves as an implicit tax on remittance flows.

Export earnings from conventional sources remain highly dependent on agricultural products, such as coffee, oilseeds, and khat, that smallholder farmers produce with a very low level of productivity and value-added. The subsistence-oriented production system does not have much in the way of marketable surplus except for a few cash crops exported to foreign markets.

An economy cannot export what it does not produce beyond and above not only the subsistence priorities of the farmers but also the domestic market’s needs. For decades now, the economy has consumed more than it produces, leading to a recurrent resource gap that has been financed by foreign aid or loans.

Overall, it is an inescapable fact that to address the economic challenge of Ethiopia, there is no other way than via the agricultural sector, which still absorbs nearly 65 percent of the labor force and contributes nearly half of the aggregate output. It remains burdened with an extremely suffocating working environment and policy distortions ranging from land tenure insecurity, implicit taxation, relative price distortion, a lack of capital stock and investment, and an increasing prevalence of soil fertility depletion and salinity.

Instead of structural transformation, the agricultural sector is burdened with an excessive and increasing labor force and a depleted capital stock base, which eventually pushes the sector to the brink of breaking point.

The predominant situation in the economy is such that the entire local economy could not produce and export as much as the poor Ethiopian diaspora community members manage to send in remittances to their families. On the demand side, the challenges of the local economy to produce the necessities of life for a rapidly increasing population have led to an increasing reliance on imports of food and other basic necessities and conveniences of life.

While the services sector is becoming more exposed to a tradeable market, its overall balance shows no significant net inflow to the economy. As a result, the economy runs recurrent current account deficits, financed by borrowing from the rest of the world. Moreover, the government sector is running a structural fiscal deficit and resorts to all forms of distortive and coercive financing mechanisms that further marginalize and burden the private sector.

These features of payment imbalance have given rise to the accumulation of external debt with our trading and development partners. This, combined with very poor allocation and utilization of borrowed resources, has given rise to an unsustainable debt service burden and default risk. There is no starker barometer of the unsustainable debt burden situation than when a relatively poor and greedy country like China sees no hope of collecting its maturing loans to Ethiopia and decides to write off part of the debt instead.

All these structural problems regarding the management of the foreign exchange system suggest that addressing the problem requires structural reforms that fundamentally change the way the economy operates. The central issue is to examine the kind of structural hurdles that prevent economic agents from transforming their subsistence farming into a thriving business enterprise with sustainable productivity improvement and more significant marketable surplus and specialization.

Some of the challenges include land tenure insecurity, access to basic agricultural infrastructure and financing, a lack of bargaining power with the rest of the economy and the politically vocal urban sector, a lack of appropriate technology, and sectoral policy distortion. Each requires major endeavors, and yet when they come simultaneously, they demand going to the drawing board and working out a new and plausible plan to initiate an economic renaissance and rebirth.

In the area of the foreign exchange market, isolated measures of devaluation do not address the problem and might as well push the spiral even further. Surprise intervention to adjust an overvalued exchange rate seldom works in the medium-to-long term.

The emergence of a parallel foreign exchange market is often a symptom of such a misalignment and provides a shadow price for the scarce hard currency. Criminalizing the black market hardly works for practical reasons. The parallel market is itself behind the curve because it operates in a partial and distorted asset market setting.

Ethiopian authorities are currently in consultations with the International Monetary Fund’s (IMF) team on reform policy issues. While such consultations are important, unless a solid policy position is established to negotiate on fundamental and structural issues of the economy, the outcome of such lopsided consultations is often weak and counterproductive.

A new policy framework is required to address the problem in a comprehensive manner. The economic authorities should commit to addressing the priority challenges of the economy and allocate resources and policy attention that are commensurate with their importance in the national economy. Once the macroeconomic stability objectives are achieved, more liberalization measures could be undertaken without undue adverse impact on the performance of the national economy.

While the International Financial Institutions (IFI’s) policy liberalization measures forced upon policymakers help address the demand management elements of the problem, structural and long-term real policy targets must be given equal priority. However, this requires a well-crafted and sound policy negotiation position that clearly sets the policy trajectory and credible parameters to be achieved in a timely and consistent manner.

What Ethiopian policy authorities have presented so far has been a wish list that does not have credibility or a mechanism for achieving it. As a result, negotiations become one-sided and often result in conditionalities that are clearly not in line with the national economic interests and priorities of Ethiopia. This must be addressed with a capable team of local experts and policy analysts developing a realistic economic policy vision and roadmap.

There has been recent discussion regarding the issue of the integration of the official and parallel foreign exchange rates through devaluation measures. The IMF’s negotiators have been promoting this position for a while, and its strategy makes use of a demand management framework. While the institution has considered prudential macroeconomic policy management as its recent policy approach, it still follows the old rules in dealing with poor countries.

In the context of Ethiopia, the demand management approach does not work unless it is set within a structural and long-term policy reform framework. An isolated approach by tweaking the exchange rate will take Ethiopian policymakers down a rabbit hole with costly economic consequences.

Demand management in economies like Ethiopia could only be used within the framework of a structural policy shift that adequately addresses the root challenges of the macroeconomic situation and the poor health of the local economy. Devaluing the Birr without first addressing the vicious hurdles that have trapped economic agents from fully realizing their potential cannot address both inflation stabilization and international payment challenges that the economy is currently facing.

In the context of Ethiopian monetary policymaking, there is a fundamental problem with how policy is carried out, both in terms of operational autonomy and accountability as well as institutional capacity to carry out and deliver on stated goals. The National Bank of Ethiopia (NBE), with its monetary board, has miserably failed in all barometers of policy evaluation and effectiveness.

The current approach invites more risk to the system as economic agents may develop general expectations about the ever-weakening Birr and prefer to put their liquid assets in hard currencies or real assets instead. Such erosion of public confidence in the Birr could trigger a crisis that no amount of intervention on the part of monetary authorities or the government could manage. In such a situation, it is no surprise that the local economy is in recurrent distress and that policymakers are reacting at random with knee-jerk reactions to the symptoms of economic imbalances within the system.

It is critically important to address the distortion in the policy landscape and immediately institute policy measures that realistically reflect the health and challenges of the economy. At the same time, the government needs to remove the policy-induced hurdles that prevent private economic agents from engaging in productive, efficient, and competitive economic activities.

This is most evident in the agricultural sector, where the potential and the actual performance have a glaring gap of opportunity. The sector has been neglected for too long and is starved of the necessary capital and tenure security to make agriculture a viable economic activity for farmers. Investment in agricultural infrastructure, water and energy systems, and market networks are basic necessities for farmers to benefit from their efforts in agricultural and non-farm economic activities.

It is only such an economic and financial environment that would promote sustainable economic growth, employment creation, and a healthy payment system. Such a policy pathway provides a more prudent and pragmatic approach to dealing with the country’s accumulated economic problems.

In order to address these issues, I would recommend a sequence of policy considerations, including undertaking credible policy measures to correct the macroeconomic imbalances before adjusting the exchange rate policy regime. The poor performance of the economy and its failure to generate marketable surpluses are the main constraints to export growth, more than the relative price regime or exchange rate.

By addressing the supply-side bottleneck and disruption to deal with economic growth, employment, debt, the fiscal deficit, and balance of payments problems, the exchange rate alignment becomes justifiable.

Removing the distortion in the financial and asset markets that creates a disincentive to saving and investment initiatives also needs to be considered. The Treasury bill market and the negative interest rate in the financial sector must be corrected in time.

The commitment to allocate sufficient investment in smallholder agriculture and ensure their food security and marketable surplus generation is also crucial. The effective use of the abundant unemployed and trainable educated youth for short-term technical training to engage in infrastructural building in integrated water, irrigation, river basin development, energy, and agro-processing sectors is necessary.

Once the economy is stabilized and major gaps in output, inflation, and real interest rates are addressed, a comprehensive economic policy roadmap with the consultation of stakeholders and experts should be conducted to effectively negotiate with IFIs and set the economy on a sustainable and shared economic growth path.

Abu Girma, PhD is a professor of economics at the Graduate School of International Public Policy, University of Tsukuba, Japan.

Excellent article written in such elementary language even laymen in micro/macro economics like could understand. I wish well read and level head experts like Obbo Abu bin Girma would seek out each others and band together to lend experts helping hand to the countries of the HOA. I have a suggestion to my dear countryman. How about Obbo Dr. Suleiman Walhad? Assume this is an order from this beyond-repair Afro-centric junkie????????????????????